With the big surge in the VIX Friday, the one thing that caught my interest was selling. No, not selling my positions – selling PREMIUM.

When we see volatility rise in uncertain and fearful times, option premium gets lifted as well. Buyers flock for protection using instruments like VIX, the volatility ETN’s, and index puts, not to mention selling futures.

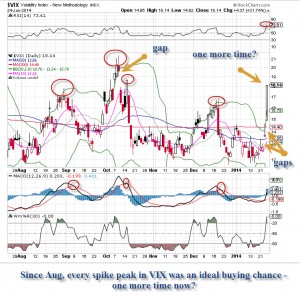

This behavior is clearly reactionary and for the most part temporary. Just take a look at the VIX daily chart over the last year and tell me those spikes were not great opportunities to get long (or short) premium. The last time we saw a VIX spike was during the panic associated with the budget problems in Washington (where else?), when the situation was pushed past the 11th hour. With panic and uncertainty all around, it seemed everyone said, “I have had enough! Get me out!”

While the pain of being long during a steep drop lingers, moving to the side was the worst thing you could have done. Take a look at the chart below. That spike you see on October 9 launched a violent rally that took the SPX 500 up to the 1850 area – twice.

The drop on Friday and the spike in the VIX brings us back down to levels not seen since a breakout in December. Is there further downside, and is there cause for alarm about the uptrend? I don’t know for sure, but I’ll take my chances with previous VIX spikes. These opportunities are few and far between, but they’re ones that I like to jump on.

How did you react to Friday’s drop? Did you panic? That drop was as nasty as could be, so I couldn’t blame you if you did pull the plug. But was that drop the start of something new or a great buying chance?

As a technician, I look for repeatable patterns in charts, which reflect behavior of investors and traders. The most predictable behavior is fear and greed, both which are clear as crystal on a chart. Fear is a fast, sharp, severe and painful move down that brings in doubt about the trend.

This current bull trend is long and may be tiresome – it has certainly exhausted the bears! For more than 400 days, the SPX 500 has been above the 200 moving average – just an astonishing number. Does that mean it’s over? It’s really not our job to guess; instead, we need to focus on the action and interpret what it is telling us.

So, back to selling premium. It takes some courage and trust to believe patterns are going to work – until they don’t work any longer. Some of the best plays I’ve made over the past year on big VIX spikes have been in names like Apple, Priceline, Google, Gilead Sciences, Mastercard, Spy and IWM. My strategy has been to sell put spreads, define my risk and let the trade play out with time. I like to collect big premiums, so my plays generally involved selecting a 5 or 10 point spread and trading a 1:1 risk ratio (for example, collect 2.5 or more for a 5 point spread, front month).

Now, is this a bullet proof system without holes? Of course not, but what if the fear is unwarranted and temporary? Do we have to wait for it to subside? If you do, you miss the chance to take in nice premium that will vaporize quickly.

If we’re wrong and there is more downside to go due to some other issue (or a continuing one)? Well, our risk is defined and we can always try the other direction if the setup is there.