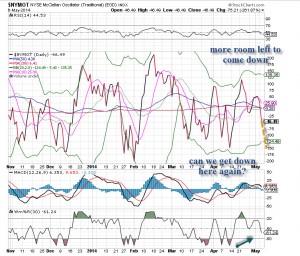

During the last few years, I have been following the breadth trends and using the McClellan Oscillators as my guide to uncover short term reversals. I look for extreme high or low readings, which have proven to be dependable markers. (Generally speaking, this is not my game, but I absolutely listen to the markets when the rubber band is stretched as far back as possible. If I don’t, I’ll get stuck zigging when the market is zagging.)

Recently, we have not seen the levels that previously gave us good tops or bottoms. Instead, the markets have reversed sharply BEFORE a low or high was reached. A pattern change? Perhaps, but the extreme levels of fear and greed do not go away, so we’ll continue to look for these moments and play accordingly. As options traders, these points are ideal for placing higher probability bets.

You can see from the charts below that more downside is necessary. The question is, will we get it?