By Tony Owusu

During Tuesday’s “Off the Charts” segment on Jim Cramer’s ‘Mad Money’ program, Cramer discussed recent pullbacks in the Internet sector and whether there were opportunities to buy low amid investor consternation.

“So which is it? Are the major online tech plays overextended and the recent profit-takers right to nail down their gains? Or do these stocks have more room to run,” Cramer asks.

For answers, Cramer enlists the help of Real Money Pro contributor Suz Smith, and points to sector stalwarts Facebook (FB) and Alphabet (GOOGL).

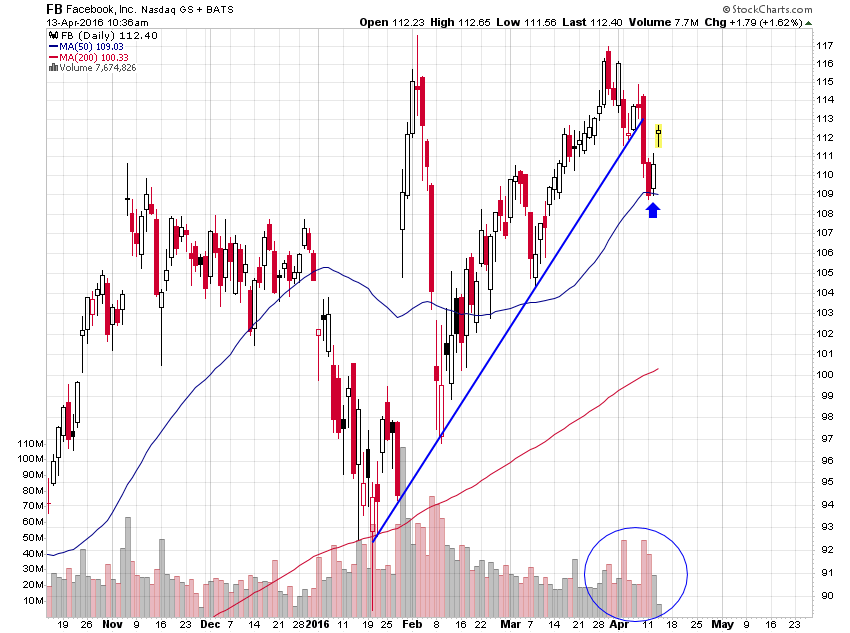

Starting with Facebook, reporting its earnings April 27, Smith says the company’s chart was moving higher before it started pulling back last week. The stock then tested its 50-day moving average at $109 during Monday’s session, before roaring back Tuesday.

“My view? I like Facebook. We’ve owned it since it was in the $20s for my charitable trust, which you can follow at Action Alerts PLUS, and if you can buy it into weakness going into earnings in two weeks, that could be a smart call, particularly since the chart is now looking up,” Cramer says. Part of the reason for the social media company’s ascension in Tuesday’s session is its annual F8 developer’s conference, which concludes Wednesday.

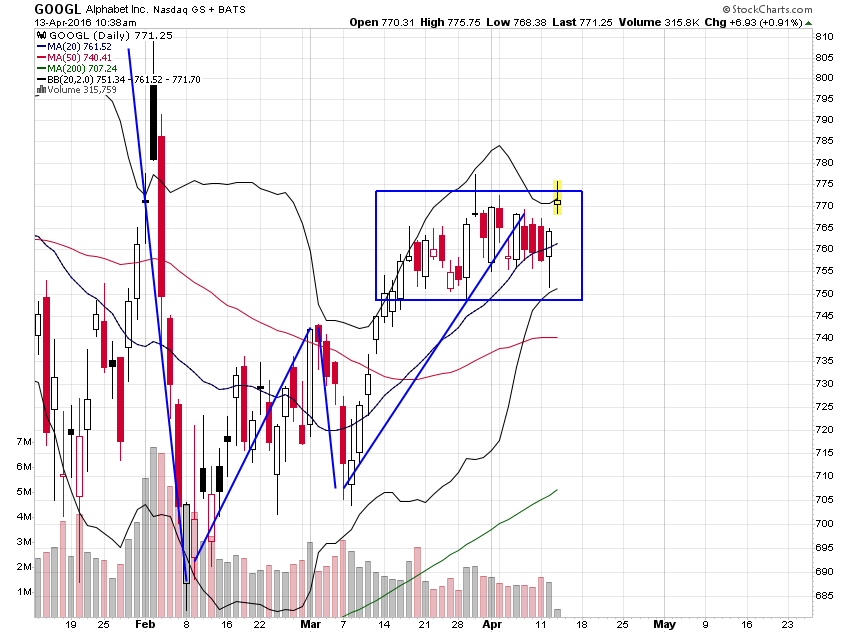

As for Alphabet, set to report quarterly results April 21, chartist Smith points out the company’s strong uptrend since early March. Though the chart also made a ‘W’ bottom with prices bottoming, quickly rebounding, but then falling to a second low, near the beginning of March.

“As I explain in “Get Rich Carefully,” this kind of W-shaped bottom is one of the most reliably bullish patterns in the chart game, and now Smith thinks that Alphabet has moved into a period of consolidation, where the stock has been trading sideways for the past few weeks and digesting last month’s gains,” Cramer says.

Smith sees Alphabet’s stock rising between $43 and $45 from current levels, after it reports quarterly results next Thursday. Based on Alphabet’s current trading levels, Cramer notes that such movement would put the stock over a psychologically important hurdle at the $800 level.

“Me? Hey, I’m a fundamentalist, not a technician, so if you can buy this stock into weakness, I’d put on part of your position before the quarter and then wait for the numbers, in case the stock pulls back for some reason and you get the chance to buy more at a lower price next week,” Cramer says. “Worst case? Alphabet blows away the numbers and you only own a small position rather than a big one.”

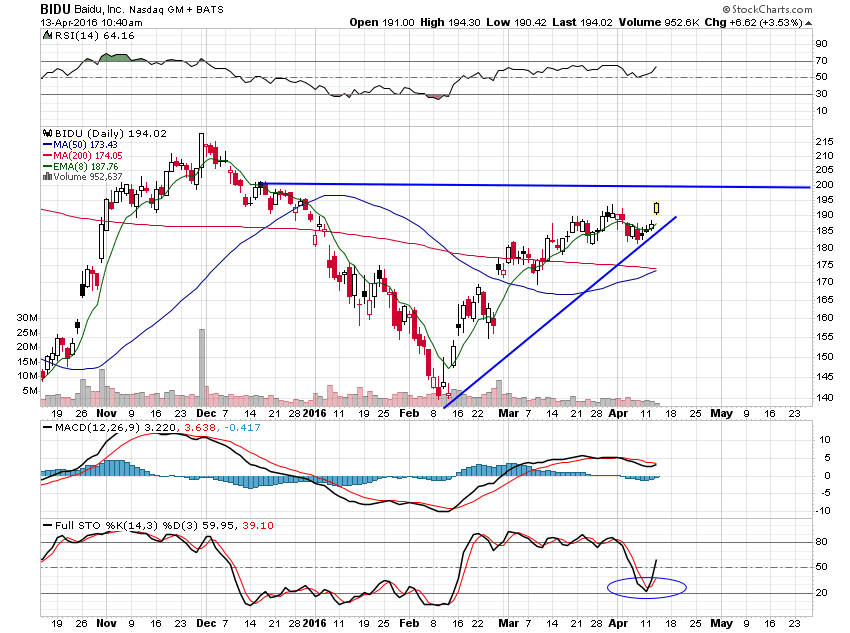

Cramer then turns his attention to Chinese search-engine company Baidu (BIDU – Get Report) , which reports its earnings results May 4. The company’s stock has been stuck in a sideways pattern, consolidating on lower volume, which Smith says is a sign it could be building up steam for a jump higher.

“She thinks that if Baidu can rally past its recent high of $192, up less than five bucks from where it’s now trading, that would set the scene for a run up past the crucial $200 level,” Cramer says of Smith’s assessment. “And you know what? Smith might very well be right, because lately we’ve gotten some real signs that China’s economy could finally be turning, something that would be excellent news for Baidu. That said, this one is too risky for me to bet on.”

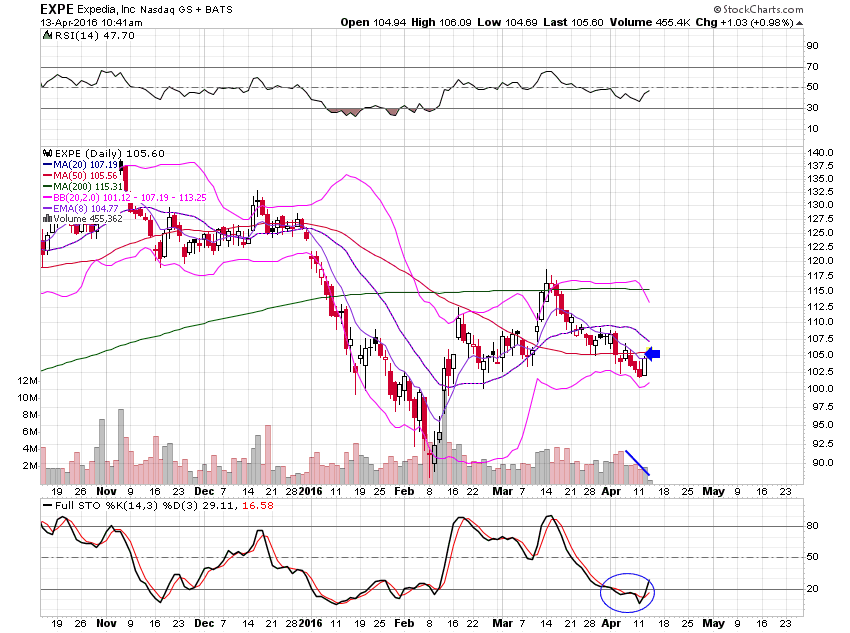

The final security Cramer mentioned in Tuesday’s segment was Expedia (EXPE – Get Report) , which Cramer said is in oversold territory. He is still bullish on the company. However, Smith isn’t as optimistic on the sector as whole, saying online travel plays are resting at their current levels. “Fundamentally, I like the stock very much and think it’s the premier online travel play,” Cramer says. Expedia reports its results May 5.

Overall, Cramer is bullish on his two AAP holdings, but is less so on Baidu and Expedia. However, those two companies also have potential ahead of their earnings releases, but they need to move up before they can add fuel to the fire.

“I’m attracted to them all, but the trust only owns Facebook and Alphabet, and I’ll stay with those recommendations for long-term, not short-term, capital appreciation,” he concludes.