Interested in trading for income? In this three-part series for advanced traders, I will share with you the top methods I use to generate monthly returns for my clients. I’ll cover directional trades, non directional trades, and trend following methods.

Directional Trades

You’re probably already aware of – and use – the basic strategy of directional trading. You buy a call if you think a stock is going up, or you buy a put if you think a stock is going down.

For the directional trade to work, you have to know details about the stock, like when earnings are coming out or if the company is going to make a presentation. You must be correct about the direction of the stock, time period and what price it will strike to. You also have to be correct about the stock’s volatility and overall market volatility, as they influence whether the option price will go up or down.

That is quite a few decisions to make before placing a directional risk trade. Of course, the more decisions you have to make, the easier it is to make an error. The more decisions you can take out of the equation, the better your odds of a profitable trade.

Non Directional Trades

It is also a well-known adage that 80% of all directional options trades expire worthless. Over the years, I have learned how to exploit this trend and put the 80% on my side. I buy and sell options using different trade structures, which allows me to create income streams for my clients regardless of the overall market conditions. This is called non directional trading, and it lets you profit from option premium decay over time.

My favorite vehicle with the highest percentage of successful trades come from the SPX Credit Ladder.

Let’s start with the advantages of this method of trading:

- Your entries are structured the same each time. Your focus is not on being right or wrong, it is on managing risk.

- Your trade structure is significantly out of the money, so you have a low directional exposure. A very strong move in the market may cause you to make an adjustment, but you do not have to worry about day-to-day fluctuations.

- You do not have to worry about earnings risks, as you focus on the same asset. The major risk here is a black swan event (the markets move hundreds of points higher or lower on news of an unforeseen event, like 9/11 or a catastrophic weather event).

- The credit spreads do well in a choppy or range-bound market, as they are high-probability trades.

- The credit spreads are not time consuming to select or maintain and are a great option for people who work full-time jobs.

I want to be very clear here: A magic method to trading doesn’t exist. Any money you put into the market is financial speculation. However, by adhering to the rules, you can significantly improve your odds of creating and maintaining a steady income stream.

The Non Directional Trade Structure

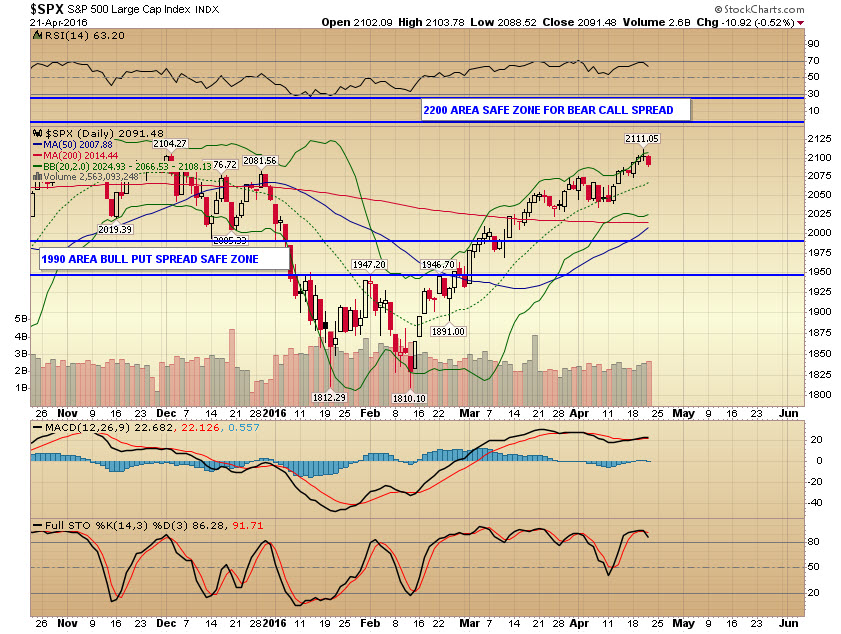

1. Look at the SPX chart, specifically the highs and lows and where it is currently trading, and the MACD and Stochastic to see if we are getting ready for a trend change. Take the level where we are currently trading (in the chart below, it’s 2091.48) and subtract 100 points for a bull put spread or add 100 points for a bear call spread. Consider this your “safe zone.”

2. Based on the SPX chart, make sure the point range is underneath major moving averages (20 and 50) and outside the Bollinger bands. For a bear call spread, make sure you are not selling at a gap area.

3. Now take a look at the options chains. Start with the weekly chains, and see how much premium you can get for a 25 point spread. Go as low (or high for bear call spreads) as you can while still maintaining a decent premium capture.

4. A 25 point spread requires $2,500 in buying power. Try to collect at least $2.10 in premium while staying within a two to three week expiry window. This will give you an 8% return on your money. Get as much premium as you can while staying in the “safe zone.”

5. Plan on closing the spread for a dime. That’s what the extra $0.10 in premium represents. If you do this in a ten lot using weekly options, the 8% will generate $2,000 per week in income on $25,000 buying power.

6. Exploit this strategy when major market moves happen to the upside or downside. If the market has a serious downside, I will put on the strategy in larger size. I prefer the bull put spread over the bear call spread, as you never know how far a market can run.

7. Think of your trade this way: the market is not likely to go “here” by “x” date.

8. Ladder your spreads: May week 1, May week 2, close may week 1, and put on May week 3, etc. These are referred to as rungs. Do not overly commit your portfolio to this strategy. The same risk tolerance applies here as it does to any other trade. Be forward looking when starting out – you may have to start with a May monthly to capture the premium.

9. Try to sell high volatility. This means you should favor bear call spreads over bull put spreads, as the premiums will be higher for the calls.

10. You can sell both bull put spreads and bear call spreads. This is a condor. I’d recommend trying one side first to get comfortable with the strategy, and then build upon your knowledge base from there.

Full disclosure: I have a variety of SPX credit spreads currently open. For information on my portfolio management services please contact me at suz at investsps dot com.

Copyright: dogfella / 123RF Stock Photo