As if on cue, the level of market noise is starting to rise. We are right near all time highs, so this really doesn’t come as surprise. Here’s a look at what the pundits are saying about the markets – and what’s really going on.

“The market rally will end soon!”

As we saw markets take out resistance on Friday following the strong jobs report, the drumbeat from the bearish side has gotten louder. They are insisting that this most unbelievable market rally has to end soon. Of course, they provide no time estimate on that prediction. It reminds me of the saying, “Give ’em a number or a date, but never both.”

Whenever we are nearing all time highs, traders and investors look for advice on what to do next. Here’s what I tell them: The market will always tell you first.

“August is always a bad month.”

I’ve been hearing a variation of “August is always a bad month – volatility always rises” a lot lately. Really? Tell that to the markets, which rose .5% last week!

When the markets reach elevated levels, we have to focus on the quality of the market rally. Only then will we know how strong or weak the market is and whether it will retreat or continue higher.

“Avoid stocks. And bonds. And anything that’s not gold.”

Lately, veteran hedge fund manager Jeff Gundlach, who has been a bull on bonds (and very correct), alerted everyone that he is avoiding stocks. Just last week, the famed Bill Gross said he hates stocks, bonds and just about everything except gold. Are these the experts we need to pay attention to?

If you want to lose money, sure! The markets hit all time highs despite their pronouncements. Thanks for nothing, guys!

In essence, they are trying to time the markets. While they may eventually be right (heck, all markets go down at some point), it is an exercise in futility. The truth is, we have no idea what the future is going to look like. You may recall that just a couple of months ago, Icahn, Soros, Druckenmiller and several other well-known investors were predicting doom and gloom for the markets. Boy, were they wrong.

Turn off the market noise – and look at the charts

As you hear me say so often, we need to focus on what the market is actually doing and not the market noise in media. Only then will you know how to proceed.

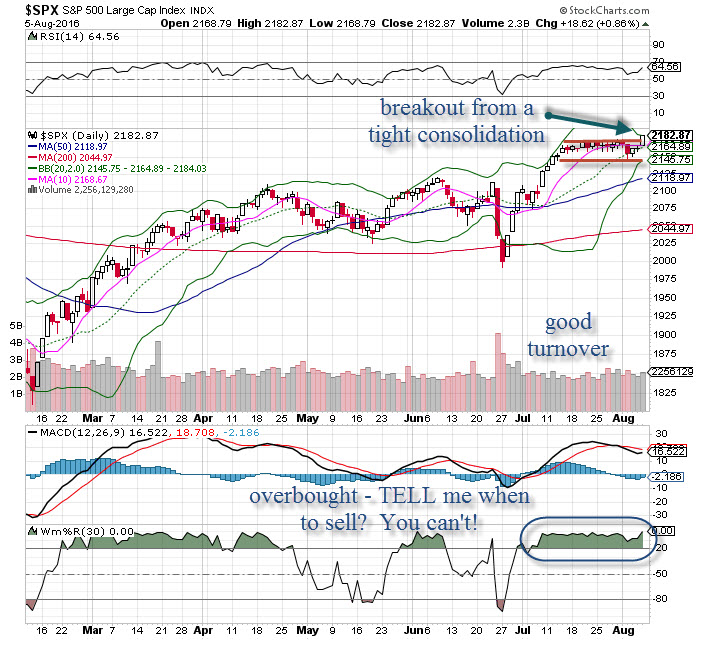

Let’s take a look at the SPX 500 chart.

On Friday, a breakout on expanded turnover after a sideways consolidation could have gone either way. However, history tells us that when the market is basing at a high level, a breakout will be higher, which is exactly what happened.

However, the indicators continue to reflect overbought conditions. Even though the quality of this breakout is solid, we know that is NOT a reason to sell or become bearish. Momentum trends can and do stay strong longer than most expect – and that is why it is so difficult to time the markets.

So what does this mean for us as traders and investors? For now, we’ll stay with the market trend and expect that, at some point, there will be some give back.

We’ll also remember that if the markets break down, we’ll see it in the charts – and we won’t bother listening to the market noise.

Copyright: nexusplexus / 123RF Stock Photo