You may have suspected it, so I’m going to confirm it: we are in a bear market. After finishing up strong for April, the bulls could not hold onto the ball. On the last day of April, the markets made a nasty reversal and created an “outside day”. An outside day occurs when the market hits a higher high and a lower low than the previous day. It is an ominous sign for the bulls and points to lower prices ahead, but before we get into that, let’s step back and look at the markets from a wider lens.

We are in a bear market

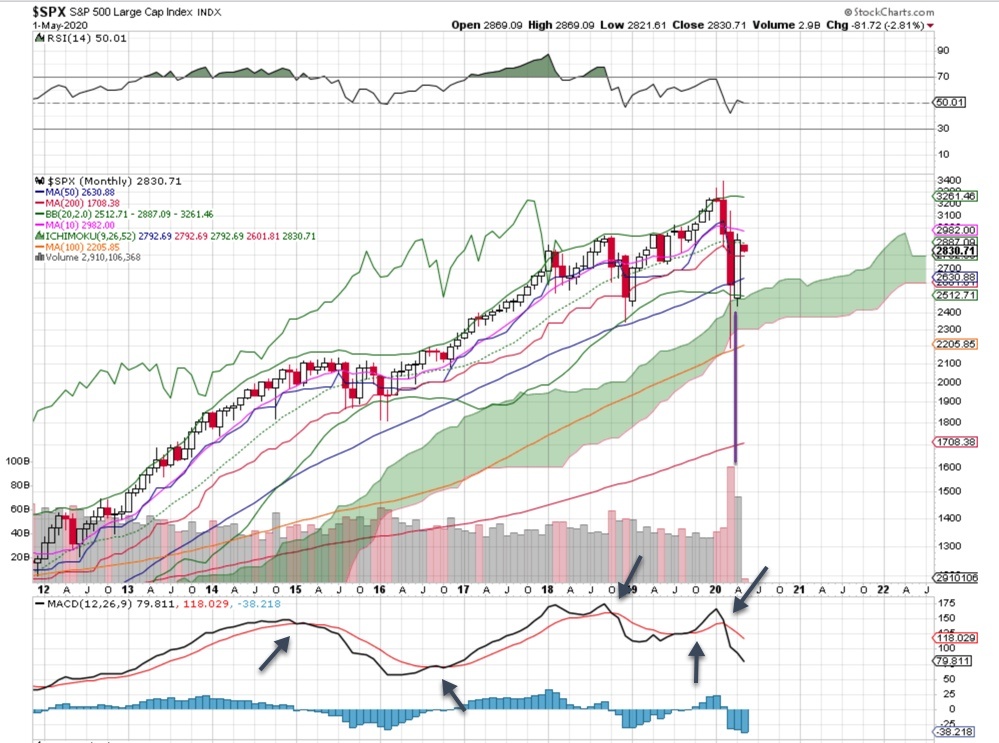

If we define a bear market based on the technical condition, we look for a crossover of the MACD line on the monthly chart, followed by a confirming bar. We do this for two reasons: The monthly chart filters out short-term noise, and a crossover move accurately determines a new, long term trend.

Look at the S&P 500’s MACD reading above. When the black line crosses below the red line, it signals a bearish trend. Conversely, when the black line crosses above the red line, it signals a bullish trend. After a strong start to 2020, the MACD line fell sharply in February, crossed over in March and confirmed that crossover in April. Even with the strong move up last month, the market remains mired in a bear phase.

In case you’re wondering – yes, it will take a while for the bear trend to play out.

This is not the end of the world. A bull market goes up; a bear market does not. Instead, it often moves sideways. While it can be frustrating to trade a bearish condition – it is more volatile than a bull market – it helps to remember that it’s just a phase in a growth economy. It’s a slowdown from a very brisk pace.

This bear market is very different from previous bear markets, because so much remains unknown. Do your best to embrace the trend. Change your trading strategy, add index puts as protection and hold more cash. (You can find more guidance in our free ebook, How to Manage Your Trading During a Bear Market.)