The Fuse

Futures are mixed early today after a pretty mild day of trading. After Tuesday’s market tirade there was nothing much to do Wednesday but watch the paint dry. It was a great day to sit and watch and observe, the action was narrow. Winners barely beat out losers while the internals showed little followthrough from yesterday’s drubbing.

Day 2 of Chair Powell’s testimony was not as harmful to the bulls as the prior day. Perhaps some cold water to the face on Tuesday was just the pause that was needed.

Yields are up modestly today, the Nasdaq is weaker early on as we await some important data. European stocks opened lower and have struggled Thursday after the hawkish talk from Fed Chair Powell over the last couple days.

Strong earnings this morning. from BJ’s Wholesale and JD, a Chinese online retailer.

Nothing spectacular to watch for today, but SPX futures are trying to hold the 3980 level. That is an important balance area and where we find buyers and sellers congregate (heavy supply). If that fails to hold, the 200 ma is likely to be tested for a third time in a week.

Breadth was moderately positive but struggled all day long. There seems to be a buyer’s strike here, but with the strong move down on Tuesday the onus is on the bulls to flip this around.

Volume was rather low yesterday, but picked up the pace on the way down when sellers emerged. There seems to be some support here around 3970, but of course the news may change that very quickly.

As we mentioned yesterday morning, the markets were looking rather tired and due for rest. Who knew that Chair Powell was going to knock the legs out from under the bulls.

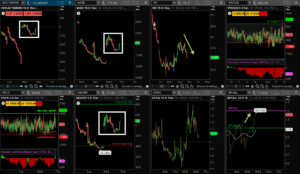

The Internals (click chart to open in a new window)

What’s it mean?

This was about as neutral a day as you could get. Markets traversed about 1% from top to bottom, but finished just about midpoint on the session. The internals show the strife during the day, with VOLD, ADD and ADSPD all winding up near zero. Curiously, put/calls were elevated again, second straight day above 1. VIX went down hard, a big reversal from yesterday’s action. We may have another day of chop tomorrow before Friday’s job report.

The Dynamite

Economic Data:

- Thursday: Challenger job cuts, jobless claims

- Friday:non-farm payroll report

Earnings this week:

- Thursday: BJ, LOCO, ULTA, DOCU, ORCL, JD

- Friday: BKE

Fed Watch: Fed Governor Michael Barr will be speaking today. Also, we are watching fed funds futures, which fell hard as rates rose sharply following Chair Powell’s Tuesday testimony.

Stocks to Watch

Name – SPX 500 – Can the index get back above 4000?

Name – Oracle (ORCL), earnings after the close – will it follow in the footsteps of CRM or MSFT?

Name – China-related stocks like BABA, BIDU, JD, PDD, as they have been sold recently and are sitting at support.