The Fuse

Equity futures are down this morning after falling just after the European markets opened lower. That region is seeing higher inflation and lower growth, which translates to a stagflation environment. US companies are reporting decent earnings but the bar has been set low.

Interest rates are dropping again as the long end of the curve continues to portray there will be much lower growth down the road or possibly a recession.

Not much on the news front this morning but markets are starting to fret about the debt ceiling fight that could rattle markets.

Solid earnings from Pepsi and MMM this morning have these stocks moving higher, while McDonalds also beat across the board. We’ll have quite a few big earnings out later tonight including Microsoft, Alphabet and Visa.

Market players continue to wait for the big earnings releases which start after the close on Tuesday.

Breadth actually made its way into the plus column. With so much negativity recently it did not take make to climb that wall of worry. Yet, the oscillator turned lower yesterday so we are on guard for some more downside into the end of April.

We continue to see 4200 as very strong resistance. In fact, the SPX 500 has not even made a bold attempt to climb that level, but perhaps that changes by the end of the week/month.

What’s it mean?

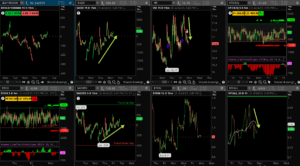

A pretty quiet day all around, but some selling did happen mid-session. The volatility sellers came charging back, notice the down move in the VIX once again, though with higher lows on the chart. The VOLD pretty much stayed by the flat line, but the ADD and ADSPD continue to move upward, and the put/calls are moving lower. This might be end of month activity or related to last week’s option expiration.

The Dynamite

Economic Data:

- Tuesday: Housing Data, Consumer Confidence for April

- Wednesday: Durable Goods, Mortgage Apps

- Thursday:GDP 1st Look, Q1, jobless claims, home sales

- Friday: PMI, Employment Cost Indext, PCE, Michigan consumer sentiment

Earnings this week:

- Tuesday: VZ, UPS, MCD, GM, MMM, PEP, SPOT, RTX, HAL, MSFT, V, GOOGL, CMG, TXN, JNPR, ENPH

- Wednesday: BA, HUM, HLT, TECK, ADP, TMO, GD, BSX, ROKU, META, NOW, ALGN, URI, KLAC, TDOC, WM

- Thursday: AAL, LLY, VLO, MA, CROX, MO, ABBV, MRK, AMZN, INTC, SNAP, NET, FSOR, PINS GILD, AMGN, CAT, DPZ, SAM, X, HSY, MBLY, COF, DLR

- Friday: XOM, , CVX, CHTR, CL, LAZ

Fed Watch: After a bunch of Fed speakers last week we head into the quiet period before the May 2/3 committee meeting. Fed funds futures are showing an 85% chance of a 25bps rate hike at the meeting.

Issues/Stocks to Watch this Week

Earnings – A huge amount of names report this week, more than 1000. Will they beat and raise guidance for the year?

GDP Q1 – First look at the US earnings, Atlanta Fed GDPNow has an estimate of 2.5%. We’ll be watching the inflation portion closely.

Housing Data – With a sharp drop in interest rates, there is a slew of data out this week that will give us good information on the health of this sector.