The Fuse

Futures are up solid today after a two day selling purge. We’ll see if that continues today or a turnaround from mild oversold conditions.

Market players are shaking off the strong inflation data, today being the first day of ‘window dressing’.

Interest Rates are on the rise this morning following the hot price index numbers released with GDP.

Strong earnings from Meta last night are stoking the rally. Last night the Republicans in the House passed a bill to head off a debt ceiling impasse. Inflation data came out and it was very hot.

Caterpillar is slightly down while Lilly is very strong after posting robust earnings earlier. Mastercard beat and raised guidance. Ebay last night had a nice beat but is pulling back a bit. Align and United Rentals beat but their guidance was suspect.

Meta is the big earnings report to come after the close today.

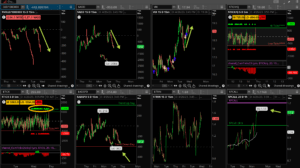

Breadth was horrendous yesterday and is now on a strong sell signal.

Some buying interest in the SPX 500 and Nasdaq below key levels. Volume is strong and volatility sellers are active today, meaning we could get a sharp move higher to end the day.

What’s it mean?

Another horrendous session that puts the market uptrend in jeopardy. Notice the continued weakness in the VOLD and the rise in the put/call to over 1, that is a sign of fear, and we’ll see if it extends.

The Dynamite

Economic Data:

- Thursday:GDP 1st Look, Q1, jobless claims, home sales

- Friday: PMI, Employment Cost Indext, PCE, Michigan consumer sentiment

Earnings this week:

- Thursday: AAL, LLY, VLO, MA, CROX, MO, ABBV, MRK, AMZN, INTC, SNAP, NET, FSOR, PINS GILD, AMGN, CAT, DPZ, SAM, X, HSY, MBLY, COF, DLR

- Friday: XOM, , CVX, CHTR, CL, LAZ

Fed Watch: After a bunch of Fed speakers last week we head into the quiet period before the May 2/3 committee meeting. Fed funds futures are showing an 85% chance of a 25bps rate hike at the meeting.

Issues/Stocks to Watch this Week

Earnings – A huge amount of names report this week, more than 1000. Will they beat and raise guidance for the year?

GDP Q1 – First look at the US earnings, Atlanta Fed GDPNow reduced Q1 to 1.1%, and they were spot on.

Housing Data – With a sharp drop in interest rates, there is a slew of data out this week that will give us good information on the health of this sector.