The Fuse

Futures are flat to mixed today as the overnight range was extremely narrow. Is this a sign of a bigger move to come? It probably is, but for now the benefit of the doubt is given to the bulls based on the strong price action of late.

Interest Rates are moving higher this morning as bonds are selling off, likely some profit taking from recent gains. The Fed meeting starts tomorrow and likely many investors are taking risk off the table before their decision is announced.

Overnight, we heard First Republic Bank’s assets were taken over by JP Morgan. There will be little to nothing left for the shareholders of FRC.

This was done to fend off a possible bank run.

Some big earnings due out this week, this morning though had SOFI with a beat but a miss by CHKP. Later tonight is ANET, NXPI, LOGI, CAR and MGM.

The Fed has another big meeting this week where they will contemplate monetary policy. We expect to see a hike on Wednesday and possibly one more in June, but it’s the press conference where all of the excitement occurs.

Solid breadth the last couple of sessions and increases in new highs vs new lows has this indicator on a buy signal again.

Volume levels were pretty high to end the week on a positive note. Especially as the month came to a close, April came in nicely positive across the board (save for the IWM). First of the month usually has very strong money flows and volume.

These last two days of April really made a mark on the bulls’ campaign. Stocks bounced off some good support levels and rallied sharply. We still see 4200 as strong resistance on the SPX 500, but the COMPQ is pushing for a breakout past 12.2K. Keep an eye on this one.

The Internals

What’s it mean?

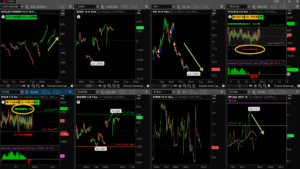

It was a slow, methodical drive higher on Friday but that push sent market higher in April. It was the third up month in four for 2023, a stark reversal from last year. The VOLD again (top left pane) tells the story here while ticks remained strong, and the VIX fell to below 16%, a stunning move. Markets are approaching overbought territory.

The Dynamite

Economic Data:

- Monday: Global PMI for April, ISM and construction spending.

- Tuesday: Factory orders and JOLTS data.

- Wednesday: FOMC rate decision, ISM non- manufacturing index,, ADP employment change.

- Thursday: jobless claims, challenger job cuts, productivity and unit labor cost for Q1 2023.

- Friday: NFP labor report, consumer credit.

Earnings this week:

- Monday: CHKP, GPN, ON, CAR, CF, LOGI, NXPI, TEX

- Tuesday: CMI, DD, ETN, MAR, TREE, TAP, PFE, QSR, UBER, ABNB, CLX, F, SPG, SBUX, YUMC

- Wednesday: BG, CVS, EL, HBI, KHC, YUM, EQIX, FSLY IR, KLIC, NUS QRVO, QCOM SYNA OLED

- Thursday: CAH, SHK, MLM, VMC, K, RACE, ICE, IDCC, AMNY, AAPL, SQ, CRUS, COIN, DASH, DBX, EXPE, FTNT LYFT, SHOP, MIS

- Friday: AMC,. CBOE, CHNI, ROAD, WBD

Fed Watch:

Issues and Stocks to Watch this week:

Apple – Releases earnings on Thursday evening, it may trigger some big market movements.

First of the month – money flows are often strong to start the month.

The Fed meeeting – Plenty of hot inflation data, too much for the committee at this point, looking for another hike or two to come.