The Fuse

Futures are up modestly this morning trying to regain some lost ground from Thursday.

Interest Rates are higher today as a potential risk on day is upon us. Volatility is down a bit as well.

It’s all about the debt ceiling debate, though the markets seem to be taking it all in stride. There is little to do but wait until a resolution is completed and just move forward, paying our bills. But the stress and anxiety created from a likely 11th hour agreement is harrowing. The US may start buying oil to fill the strategic petroleum reserve.

Not much on the earnings front today or last night but Getty Images posted good numbers as did Sanmina.

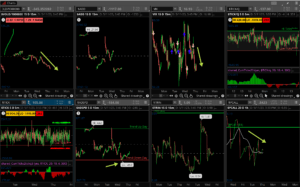

Very little movement but the Nasdaq is starting to break out of a range. However, the Russell 2K has been challenged as has the Dow Industrials.

Something to watch.

Breadth was very poor Thursday, about 2-1 negative but remains on a buy signal.

Volume trends remain muted but as long as the market is not selling off on higher volume, the bulls have the ball.

We continue to see 4200 as strong resistance for the SPX 500. There is vulnerability here with poor breadth and levels of resistance. That is a dangerous combination.

What’s it mean?

A down session with the VOLD leading the way lower. Though we did not see the panic and rush to sell we often see, notice the VIX still declined into the close. Put/call ratios are coming downward, we’ll see if the market internals improve into the weekend.

The Dynamite

Economic Data:

- Friday: Michigan sentiment, import/export prices

Earnings this week:

- Friday: SPB

Fed Watch:

With some jawboning from fed speakers this week the fed futures are now stubbornly pricing in a 15% chance of a rate hike. It makes sense really, with a tight labor market and high inflation that is not going away. One fed speaker out later on today.

Issues/Stocks to Watch this week

Volatility – The VIX was smashed down again Friday, far too low for comfort. We’ll see if it rises this coming week.

OPEC meeting – The last time they met it was a cut in production. We’ll see if that happens again, which might be a surprise.

Banks and Congress – Lawmakers say they are monitoring the situation with regional banks and their problems. Let’s hope they don’t step in and try to fix markets as they did once before – that was a disaster.