The Fuse

Futures are nicely higher as market try to shake off a down Friday. Small caps are up strong while the Industrials carry a solid bid this morning. May VIX futures expire after trading on Tuesday.

Interest Rates are higher this morning as the 2 year yield is back above 4%. After a strong few days for bonds this could be a bit of profit taking.

Maybe some movement on the debt ceiling could be happening. Talks were scheduled for this coming week, but with a deadline looming there needs to be significant progress.

We’ll have earnings out tomorrow morning from Home Depot, Baidu and a few others. So far this season earnings have mostly surprised to the upside.

Several conferences are happening this week and starting up in the coming days. We often hear some positive news out of these sessions.

Breadth was weak again but managed to come off the lows of the session. This indicator remains on a sell signal.

Volume levels retreated on Friday, we are starting to get the signs that summer trading is back. What that means exactly is low volume with erratic price moves. Oh, what fun that is!

We still see the SPX 500 trading in a box of 3800 to 4200, but we are willing to now upgrade that bottom to 4050 as a spot where buyers may come in and buy the dip. It is not very solid support as you have down at 3900, but with higher lows in place we have to respect the bullish trend.

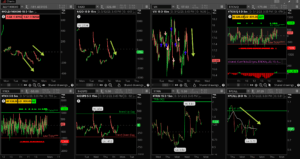

The Internals

What’s it mean?

Not much for the bulls to get excited about on Friday other than markets rallied back from their lows to close better. That’s a low bar for sure, but the bulls will take it. Notice how all the action of late is taking place below the zero line on the VOLD and ADD. That tells us volume trends are week and issues are starting to falter badly. Of course, it’s not showing up in the indices. Volatility was smashed down from the highs and remains about 17%, Put/calls ran lower and are close to a buy signal.

The Dynamite

Economic Data:

- Monday: Empire Manufacturing Index

- Tuesday: Retail Sales, Industrial production, Business Inventories, NAHB housing market index

- Wednesday: Mortgage Apps, Housing Starts, Crude Inventories

- Thursday: Jobless Claims, Philly Fed Index, Home Sales, Leading Indicators

- Friday:

Earnings this week:

- Monday: RIDE, TSEM, NVTS

- Tuesday: HD, PSFE, SSYS, KEYS, KD

- Wednesday: JACK, TGT, TJX, CSCO, TTWO

- Thursday: WMS, GOOS, EXP, WMT, AMAT, DECK, FTCH, ROST

- Friday: DE, FL

Fed Watch:

Last week we heard some rather hawkish comments from some prominent Fed speakers. We’ll hear more this coming week as the committee members talk about inflationary trends and the recent price rises as seen through the CPI and PPI.

Stocks to Watch

Tesla – With a new CEO named at Twitter, will Elon Musk revert back to the EV company full time and give them the attention they deserve?

Retail – We’ll have the April retail sales numbers this week but also many retailers report their next quarter earnings (see above).

Gold – the metal pulled back to the 20 ma this week where it should find some support.