The Fuse

Futures are on the rise and optimism is in the air over a debt ceiling resolution. Stocks overseas spilled over the bullishness and have been rising since the start of their session. As market continue to tip toe towards stiff resistance, the urge to sell becomes stronger.

Interest Rates are higher again today as the inverted curve becomes a bit less cumbersome. All eyes and ears will be on Chair Powell tomorrow.

Markets rallied hard midday Wednesday on some hopes of a debt deal coming to fruition. Certainly this overhang will be nice to remove but stocks have been pushing higher regardless. As I’ve said prior, a deal will be done and we will eventually move on from this.

In line earnings but poor guidance from Cisco last night, while Walmart hit a nice winner and raised guidance as well. Take Two also is rising but on weaker earnings, tonight we’ll hear from Applied Materials and Ross Stores.

Several conferences are happening this week and starting up in the coming days. We often hear some positive news out of these sessions.

Breadth bounced back nicely yesterday, nearly 4-1 in favor of the ups. New highs are starting to expand as well, and that will be a strong buy signal once confirmed.

Volume was elevated Tuesday as it turned into a day of distribution. That is institutional selling, and with several more of those the market is vulnerable to corrective action.

Rangebound market is what it is! Until a breakout above 4200 or below 4050 on the SPX 500 happens, we are stuck in a range, bulls are vulnerable to a sizable pullback.

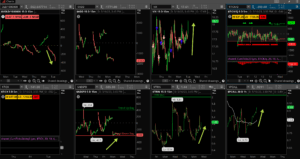

The Internals

What’s it mean?

We knew early by looking at the internals the bulls would be challenged on Tuesday. That indeed happened, and while there was an attempt to go positive the downward influences were just too strong. The VOLD pointed down all session as did the ADD, a complete risk off day. VIX was higher on the session and closed near the highs of the day, put/call is on the rise and ADSPD was nearly a trend down day. Nothing good for the bulls here, but maybe they shake it off today.

The Dynamite

Economic Data:

- Thursday: Jobless Claims, Philly Fed Index, Home Sales, Leading Indicators

- Friday:

Earnings this week:

- Thursday: WMS, GOOS, EXP, WMT, AMAT, DECK, FTCH, ROST

- Friday: DE, FL

Fed Watch:

Some Fed speakers were out earlier this week with some pretty hawkish comments, not too surprising. We’ll have three more speakers later in the week.

Stocks to Watch

Tesla – With a new CEO named at Twitter, will Elon Musk revert back to the EV company full time and give them the attention they deserve?

Retail – We’ll have the April retail sales numbers this week but also many retailers report their next quarter earnings (see above).

Gold – the metal pulled back to the 20 ma this week where it should find some support.