The Fuse

Equity futures are moving higher as the bulls try to make it three straight wins. Bullish seasonality and positive news are winning out now, but those market tail winds will be ending soon. Regardless, the SPX 500 is on a trek to hit 7K, and that might happen right on the open, we’ll see if it stays there the first time around.

Interest Rates are bumping up as most fixed income investors are awaiting news from the Fed meeting today. 2/10 spread remains rangebound but if the market is shocked by the statement or press conference today this may move. Strong economy means high yield demand remains robust as spreads are tight, fed funds seeing no change in policy today.

Stocks were not moving much in Europe overnight, France was down sharply but Germany was flat. The FTSE up .1%, the dollar index rose .2%, gold is ripping higher and right near 5,300 per ounce, silver gaining 5% as well. Crude oil is up modestly and making a move to $65 per barrel. Yields on the long end in Germany were down 2bps, 10 yr US treasury yields down 1bp, in Asia stocks were mixed, Hong Kong up a robust 2.6%, Shanghai up .3% but Japan was flat.

Earnings overnight from ASML were very strong with good guidance and bookings, the stock is leading the chip stocks higher this morning. Last night better earnings from TXN and Seagate along with F5 are vaulting tech stocks, but no question the sector is getting a lift from the hype of names reporting tonight – Meta, Microsoft and Tesla along with IBM.

The bulls are ripping it hard this week with good statistics across the board. No question we are approaching an overbought reading, perhaps when we move into the new month next week. There is plenty of news left this week to move mountains, starting with the Fed policy statement and some big earnings after the close. We did not see much in the way of widespread rallying, the RSP actually was weaker than the SPY, but that can be corrected quickly.

Positive breadth but not overwhelming, and that could be a problem if the bears can wrest control. So far the bears have acted like shy cubs, not roaring and scaring off investors/traders. Perhaps that is coming. Oscillators still positive and more impressive new highs just crushing new lows, again.

Good volume and accumulatin for the Nasdaq and Industrials but not so much for the small caps and SPX 500. That’s fine, expect bigger turnover the rest of the week, but it is good to see leadership from the big tech names. Several of them have earnings this week, 4 of the Mag 7 will report and all 4 will have. big volume prints, and likely carry other names along with them.

For the Nasdaq, pushing through the 630 level was big, now the bulls need some followthrough to make it seem real. Small caps continue to move higher, supported by gold and silver miners and some technology groups. The Russell 2K is having a banner month and could be up double digits for January, but the higher it goes the harder it will fall when buyers are hard to find.

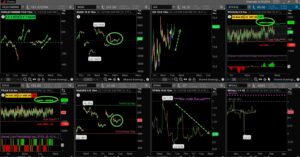

The Internals

What’s it mean?

A positive day and finally some improvement in those internals. The VOLD cruised higher end of day and finished near its highs. ADD and ADSPD were pretty weak however, put/calls are starting to rise again. Ticks were hugely green most of the day, impressive with the Nasdaq as buy programs were an hourly affair. VIX rose a bit but likely will drop after the news events hit today and tomorrow.

The Dynamite

Economic Data:

- Tuesday:Consumer confidence, Fed meeting begins

- Wednesday:FOMC rate decision, Powell press conference

- Thursday:jobless claims, productivity, trade deficit, inventories, factory orders

- Friday:PPI (dec), chicago biz barometer, Miki Bowman, Alberto Musalem (fedspeak)

Earnings this week:

- Tuesday:UNH, BA, UPS, GM, RTX, SYF, AAL NOC, CVLT, KMB, TXN, STX, NXT, PKG, PPG, FFIV, LRN

- Wednesday:ASML, GEV, T, GLW, GD, SBUX, VF, PGR, ADP, MSFT, META, TSLA, LRCX, NOW, CLS, IBM, WM, LVS, LC

- Thursday:MA, CAT, NOK, NDAQ, RCL, MO, PH, BX, LMT, HZO, AAPL, SNDK, V, WDC, SAP, DECK, EMN, LPLA

- Friday:SOFI, AXP, VZ, CNI, CVX, XOM,, CHTR, LYB, ALV, APD

Fed Watch:

The first fed meeting of the year is upon us and most likely the committee will punt on a rate move. Monetary policy looks to be stable right now, perhaps a cut may be out in the future but for now with a strong economy, job growth happening and some elevated inflation the FOMC is not likely to budge. The market is also in alignment with this thinking.

Stocks to Watch

Tesla – All eyes on Elon Musk this week as many are looking for some new announcements on product development. This is the first quarter the CEO has been focused on the company full-time in a year, perhaps that did some good. Robotics, full service driving metrics should be interesting to read about. The stock has been strong for the past few months.

Apple – All the worry warts are out on Apple this time around, but no question the company had a good holiday period. They often offer soft guidance for the current quarter we are in so that should come as no surprise. The audience is interested in hearing about their AI ambitions and association with Alphabet.

Small cap Stocks – This group has been on fire this year, rising some 9% so far in 2026 but that pace won’t last. IWM is often the driver of the rest of the market, if they sell down we’ll see if that is still the case.