As a technical analyst, my job is to find the most reliable and predictable patterns and judge whether or not they will repeat. That is a pretty big leap of faith, isn’t it?

Well, if you follow charts and technicals, you find that the patterns represent the very emotions that guide market players. Look at any chart, and you can see both fear and greed, polarized emotions on the same spectrum that we, as individuals, occupy at one time or another. We all fear losing our wealth, but we also have an insatiable appetite for building our accounts, and we will do whatever it takes to make it happen.

Fear and greed are the parameters I use when interpreting price action on a chart. For instance, I can explain big drops or surges in a stock price simply by observing price action. On Friday, ULTA was a great example of what happens when fear takes over – players were running for the hills.

Meanwhile, last week TSLA had a big surge at the open on good volume and continued higher all day long, closing high at the end of the session. No fear on this one, right? But remember, we only know positive – or negative – outcomes in hindsight.

Instead of looking backward, I want to see what the “right side of the chart” will look like down the road, and of course that is the trickiest part of all. There is no “secret sauce” for predicting the future. All we can do is learn from past patterns and trends and put together a reasonable scenario.

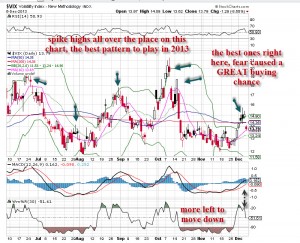

Two patterns I’ve seen this year are for the SPX and VIX (see charts below). The SPX has shown a predictable pattern of bouncing from its daily 20 MA, and on Friday it did just that. This is the fourth time this year that this pattern showed up and followed through, so when it popped up again last week, wouldn’t it have been worthwhile to get long prior to the jobs report? The setup was there. Take a look at the chart – what pattern do you see now following Friday’s action?

Over at the VIX, we’ve seen a spike followed by a very quick reversal several times this year. The action happens so fast that it is nearly impossible to jump on board. However, if you were familiar with previous patterns and knew they developed with oversold conditions, you knew that the markets reversed hard in the face of great fear. On Friday, the VIX got slammed lower after a recent 28% move up in volatility. So, is it too risky to call for a reversal of a short term move to resume the current market trend? If the shoe fits, you wear it!