With the increase in market volatility, we find ourselves reaching for and needing more certainty. Is our approach correct? Do we need to make adjustments? Is there better information out there? This last question can lead us to listening to anyone with a viewpoint, and as the number of opinions and rhetoric rise, the more confused and indecisive we get.

But is this really what we want? Do we want to be dragged along by someone who may have an entirely different agenda? My suggestion: Turn down the noise, and pay attention to what the market is saying.

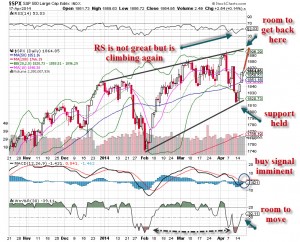

The market will tell you what is happening by giving off many signals that are evident in various technical tools. There is no guessing, judging or feeling here. High volume tells us there is interest from institutions (accumulation signals buying and sponsorship, while distribution signals selling). Momentum indicators show the power of price action and strong movement. Relative strength compares the action to indices as price consistently beats (or retreats) from a benchmark. Moving averages show direction, flow and support/resistance levels for price, which often acts as a magnet. Bands around price tell us where the majority of price action lies, and it helps us to discover accepted price levels.

Armed with the knowledge of past price and volume action, we find that patterns tend to repeat over and over again. After all, a stock chart is only a picture of human emotions and behavior (characterized by fear and greed) playing out in real-time stock prices. Price levels attract interest, and volume tells us whether that interest is strong or weak. A trader/investor with conviction will show commitment by buying or selling heavily.

I really don’t need to listen to someone’s market opinion on the tube when I have the facts right there in front of me. But it takes time and skill to filter through the information and pinpoint where we are and make assumptions about the future price levels based on the past. Is this method 100% guaranteed? Of course not, but I’ll take my chances based on past experience anytime. Look at the chart below, especially the lines and comments. The chart provides historical information, telling us where we can look for clues and base our conclusions on real evidence – not opinion.