DocuSign went public in 2018 amid a great deal of fanfare. The company revolutionized the way we gather digital signatures for agreements. Their platform was quick, easy to use and efficient, and many companies eagerly signed on (pun intended). Until this summer, the stock’s performance reflected customer enthusiasm and gained more than 200% in value since the IPO.

In late July of this year, the stock came crashing down. It has been climbing back steadily thanks to solid earnings. Note the big gap up on strong volume a month ago.

The chart is very informative. Higher lows are in place as the stock tests last year’s all-time highs. Money flow is strong and bullish, recent turnover has been bullish and the indicators are turning higher. This stock could move up and out to the mid 70’s before too long.

Here at Explosive Options, we continue to hold the January 62.5 calls bought on Oct 7.

DocuSign Chart Analysis

Take a deeper dive into the chart action (Nasdaq: DOCU) and learn how to read the technicals and my analysis as I mark up our chart of the week.

Love what you’re learning in our market analysis? Don’t miss a single video! Get the latest chart action delivered directly to your inbox every week as Bob breaks down stocks to watch and potential trade options!

About DocuSign

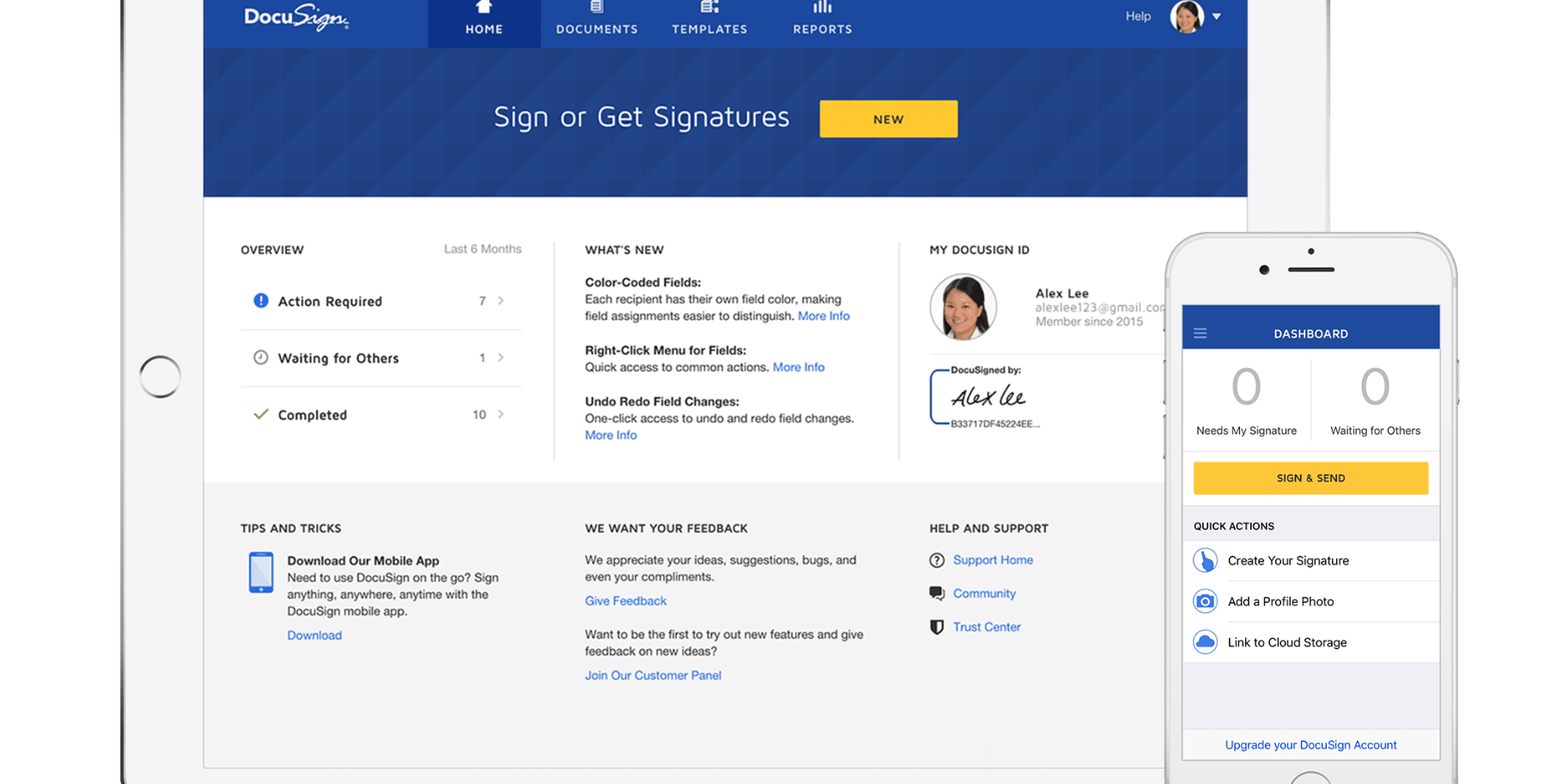

DocuSign offers an e-signature service that allows businesses to digitally prepare, execute, and act on agreements. The company was founded in 2003 and is headquartered in San Francisco, California.