The Fuse

Equity futures are trying to bounce back from a miserable Monday session. It was a total rout of the bulls as some key support levels were taken out. We are now currently just above one right now (5,050 on SPX 500) and if that falls it will be quite bearish, though we are extremely oversold here and could bounce hard at anytime.

Interest Rates are again on the rise as bond sellers continue to shed their fixed income products. Three hot inflation numbers in a row will do that. Fed funds futures are now discounting zero to one rate cut in 2024, a far cry from where estimates were at the start of the year. My how things have changed. The strong retail sales number yesterday fortified the Fed’s position of higher for longer.

Potential response by Israel against Iran sunk the stock market after a sharply higher open. The SPX 500 moved in a 100 point range from top to bottom (more actually) and closed poorly. As a result, the current uptrend is now in jeopardy, short term moving average are heading downward while longer term moving averages are either tagged or in view. The SPX 500 closed well below the key 50 day moving average and if selling continues then the 100 day moving average is a likely target at 4,900. Stocks in Asia were blasted overnight, the dollar remains strong as does gold.

Earnings from JNJ, UNH and BAC are out and United Healthcare beat lowered expectations. JNJ missed revenues while BAC reported a huge decline in revenue over 2023, profits were lower as well.

Just a nightmare for traders who were looking for some upside. The tables were turned fast and without any warning. Stocks finished sharply lower and near lows of the session, and they also took out Friday’s lows in the process. It was ugly though from the start with poor internals though the price action was better. It seems as if buyers are getting trapped at higher prices these days. Not the sign of a bull market trend.

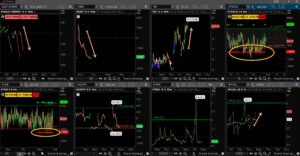

Another day of really bad breadth, this indicator is solidly on a sell signal. New lows are starting to build as well versus new highs, while the oscillators are pretty much oversold. We could expect to see a good-sized rally within about 4-5 days, but that could be from lower levels.

Strong turnover late in the memorialized the session, with very heavy selling and not a buyer in sight. This primary indicator is now on a sell signal, we have to pay close attention to price now. If it shifts to a sell signal we could see several downside targets reached all the way to 4,500 on the SPX 500..

So much for support in this market. Levels are being taken out like a hot knife through butter. Each level that gets hammered now becomes resistance, and while there will be a big rally at some point soon, it could be from down deep. We see 5,050 as an important marker for the SPX 500. The Nasdaq busted through 18K on the downside and now has plenty of room to fall towards 16K. The industrials are in trouble, with a potential move to 36K from here.

The Internals

What’s it mean?

Hideous. If you’re a bull, that’s what it felt like at the closing bell. The internals were poor even as the price action appeared strong to start the day. However, once the buying and short covering finished up the selling commenced, and what a wave we had. That VOLD was down hard for the third straight session, ADD also very poor as it was a trend down day. Those ticks again, heavy concentration of red tells us there is more selling going on that people want to believe. Put/calls raced higher and are still on sell signals. We are nearly maximum oversold here so a rally can come at anytime.

The Dynamite

Economic Data:

- Tuesday:housing starts/permits, industrial production/cap utilization

- Wednesday:crude inventories, beige book

- Thursday:jobless claims, existing home sales, leading indicators

- Friday:n/a

Earnings this week:

- Tuesday:BAC, MS, JNJ, PNC, UNH, IBKR, JBH, UAL

- Wednesday:ABT, ASML, USB, AA, TRV, LVS, CSX, DFS, CCI

- Thursday:DHI, ELV, NOK, TSM, NFLX, PPG, ISRG, ALK

- Friday:AXP, PG, SLB

Fed Watch:

Stocks to Watch

Retail Sales – This will be an important report Monday morning. Is the consumer starting to fade some? March was supposedly a strong retail month but if it is the peak, the market may respond negatively.

Industrials – While the Dow only has a handful of names reporting, the industrial complex has many names delivering earnings this week. The Industrials and Transports are in correction territory, we’ll see how much of a bounce they receive.

Apple – We’ll keep one eye on Apple, which stunned the markets on Thursday with an announcement about new PC’s coming with AI capability. That led to the strongest move for the stock in over a year. We’ll see if there is followthrough.