The Fuse

Equity futures are springing back to life this morning, feeling the love from a volatile overnight session. Futures were down about 20 handles at one point but have picked up and are now sporting a decent gain. We continue to work through lower highs, lower lows in the chart and will use more caution here.

Interest Rates on the long end of the curve are slightly higher as the yield curve flattens out. Remember back in 2022 a flat yield curve was bearish for markets, and if it continues that way we’ll see more coming off the indices.

Nothing new on the war front overnight has traders breathing a sign of relief today. Volatility is lower but is still elevated, the Euro Stoxx added .7% so far, gold is modestly lower as is crude oil, correcting from an overbought condition. Traders are waiting to see how Israel responds to Iran’s attacks last weekend. Two fed speakers today, the Fed beige book is released

ASML had an earnings/revenue miss this morning, last night United Airlines beat and raised guidance while Interactive Brokers saw their earnings and revenues rising. Travelers missed profit expectations. Later tonight we’ll hear from CSX, AA, LVS and Kinder Morgan while tomorrow is a big report from TSM.

It wasn’t as nasty as the last couple of sessions but down for sure, with breadth and depth completely awash in red. There is little stopping this market from going lower if interest rates continue to rise. At some point that will come to a halt but for now the trend in yields is higher, and that is kryptonite for equity markets.

Breadth was negative again and now we see this indicator very oversold. Nearly 2-1 negative breadth on the indices put the MC oscillators in deeper territory, though we may see a whopper of a rally soon. New lows are really starting to expand at a brisk pace, and that will just lead to more selling. The jury is still out if earnings are going to save the day.

It was a heavy day of volume for the Russell 2K which notched another distribution day. That is well over seven in the past month, this index is further into a corrective phase. The other indices are correcting as well but not as badly, hence there could be some catching up to do. We would use caution here, with the 10 year yield above 4.6%, the last time it was here the SPX 500 was at 4,600.

We talked recently about the 5,050 level and that was breached for a bit on Tuesday. Yet, we closed just above it, so a respite for now. The industrials snapped a six session losing streak, up about 63 points after bing higher by more that 240 at one point. That reversal is bearish.

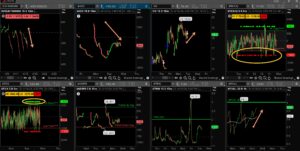

The Internals

What’s it mean?

Tough day for the bulls but some improvement (if you wanna call it that) in the internals. VOLD was horrendous again and really signals why more new lows are expanding. The same can be said for ADD, which finished at -849, off the lows but clearly not bullish. We finally saw some green ticks but that were scattered all day long, put/call is still on the rise and that will eventually mean a spike is coming. VIX remains elevated, May futures are now the front month.

The Dynamite

Economic Data:

- Wednesday:crude inventories, beige book

- Thursday:jobless claims, existing home sales, leading indicators

- Friday:n/a

Earnings this week:

- Wednesday:ABT, ASML, USB, AA, TRV, LVS, CSX, DFS, CCI

- Thursday:DHI, ELV, NOK, TSM, NFLX, PPG, ISRG, ALK

- Friday:AXP, PG, SLB

Fed Watch:

Several fed speakers out this week, Chair Powell on Tuesday. So far, the data is as such where the FOMC is going to hold rates higher for longer.

Stocks to Watch

Retail Sales – This will be an important report Monday morning. Is the consumer starting to fade some? March was supposedly a strong retail month but if it is the peak, the market may respond negatively.

Industrials – While the Dow only has a handful of names reporting, the industrial complex has many names delivering earnings this week. The Industrials and Transports are in correction territory, we’ll see how much of a bounce they receive.

Apple – We’ll keep one eye on Apple, which stunned the markets on Thursday with an announcement about new PC’s coming with AI capability. That led to the strongest move for the stock in over a year. We’ll see if there is followthrough.