The Fuse

Equity futures are up this morning as they try to stem the tide of rough seas. Stocks have been down sharply for awhile after some Fed comments on monetary policy. Chair Powell reiterated ‘higher for longer’ this week and the markets did not appreciate the words. The 50 ma is broken now and has become resistance.

April is turning out to be the worst month so far since September 2022, but there are still nice days left to rehabilitate.

Interest Rates are steady this am as the yield curve remains flattish. Fed funds futures are now predicting 40bps of cuts or just under two by the end of 2023. If inflation remains hot and next week’s PCE is worse than expected then we can expect to start pricing in cuts for 2025 at the earliest.

Stocks took it on the chin again as some good support was broken, markets fell sharply afterward. With a very deep oversold condition and extreme bearish oscillator reading, a whopper rally could show itself any day now. That is what many are looking/waiting for, but those tend to give back those gains quickly. Something like that occurred in a small way yesterday, a very large green price bar followed by several red bars, indicating a sell the rally mood is here to stay.

Earnings were strong from Alcoa last night, LVS delivered some good numbers but is lower on guidance, CSX also delivered strong earnings and guidance and is rising up about 2%. Tonight we’ll hear from Netflix, PPG, Intuitive Surgical while tomorrow is a big day with AXP, PG, and SLB and a few regional banks.

Market reversals are no fun for either side, but when the market has been in a long uptrend like this one, every selling day seems like the end of the world. While many would have you believe this is just a garden variety correction, that sort of complacency will really get you in trouble. It’s times like these when we need to be super alert and protect our capital.

After a washout day Tuesday breadth was better but still finished negative. Oscillators actually went up, there was no more room to go down though, new lows have now expanded as this indicator is turned bearish. The action is ugly but nearly an extreme oversold condition, a whopper rally can happen at anytime.

Volume was heavy and red for most of the day. Early in the session buyers came in but it was mostly short-covering, buyers did not have much conviction in this market holding up. Rates rose again and that put pressure on small caps, which in turn spilled over to the rest of the market. At some point buyers will be back, but it could be awhile.

That 5,050 level fell like a hot knife through butter, and sets up quite a bit more selling now. It may be tough to get much further down due to the oversold condition, but a gap at 4,980 needs to be filled while we can see 4,900 being a target lower (100 ma). The industrials are now down nearly 7% from the all-time highs, moving averages are bending lower.

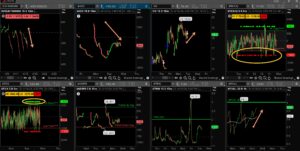

The Internals

What’s it mean?

With all the recent selling the last few days it seemed we might see a bit of upside today but it wasn’t meant to be. The internals continue to tell us trouble is now and ahead of us. The VOLD and ADD tried to make it positive but they failed to do so, while the put/call rallied sharply and closed much higher at 1.17, some real fear is evident. Ticks were evenly spread but there is still a heavy concentration of red, so plenty of selling to be done.

The Dynamite

Economic Data:

- Thursday:jobless claims, existing home sales, leading indicators

- Friday:n/a

Earnings this week:

- Thursday:DHI, ELV, NOK, TSM, NFLX, PPG, ISRG, ALK

- Friday:AXP, PG, SLB

Fed Watch:

Several fed speakers out this week, Chair Powell on Tuesday. So far, the data is as such where the FOMC is going to hold rates higher for longer.

Stocks to Watch

Retail Sales – This will be an important report Monday morning. Is the consumer starting to fade some? March was supposedly a strong retail month but if it is the peak, the market may respond negatively.

Industrials – While the Dow only has a handful of names reporting, the industrial complex has many names delivering earnings this week. The Industrials and Transports are in correction territory, we’ll see how much of a bounce they receive.

Apple – We’ll keep one eye on Apple, which stunned the markets on Thursday with an announcement about new PC’s coming with AI capability. That led to the strongest move for the stock in over a year. We’ll see if there is followthrough.