The Fuse

Not much of a bid today as the futures are down and have been weak since the overnight session began. We’ll see if volatility sellers come out again today and push the markets up.

The SPX 500 continues to make a slow push towards the February highs, just under 4200. The Nasdaq 100 is trying to hang onto 13K but has been struggling to make a surge past that area. With new highs starting to slow down vs new lows, if this indicator turns down we’ll have more bearish evidence a correction is about to ensue.

Plenty of Fed speakers out the remainder of the week, today is the first day May vix futures trading, which trades at a big premium to the vix cash (contango, bullish for markets).

Strong earnings from Abbott Labs and Morgan Stanley this morning, also solid earnings from Intuitive Surgical last evening.

Markets yawned much of the day, futures traders were chopped up like onions during the trading session. Stop running was the name of the gam,e not much momentum to work with on either side of the trade.

Breadth was pretty weak all session long but managed to close the gap for a negligible loss. We’ll find out more later in the week with data, fed speak and earnings.

Volume was lighter again yesterday as it appears buyers are running out of steam.

We are still watching the 4,200 level on the SPX 500, where we would expect to see major resistance. Further, a drop to 4100 would not be unexpected, but lower than that we have 4050 as an area of interest.

The Internals

What’s it mean?

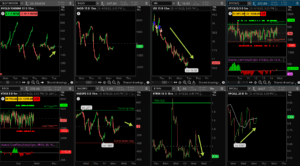

Pretty quiet session for the markets, the SPX 500 moved about 30 handles from high to low. There was not much in the way of volume, notice the VOLD with no momentum, the ADSPD was flat while the TRIN came down, so did the VIX from the highs. A snooze fest, but buckle up, more excitement to come.

The Dynamite

Economic Data:

- Wednesday: Crude inventories, Beige Book

- Thursday: Jobless claims, Philly Fed, Leading indicators, Ex home sales

- Friday: Flash PMI

Earnings this week:

- Wednesday: ASML, ELV, MS, AA, DFS, IBM, LRCX, TSLA

- Thursday: AXP, T, DHI, NOK, NUE RAD, TSM, UNP, CSX, PPG

- Friday: FCX, HCA, PG, SAP

Fed Watch: Fed tool is now seeing about a 87% chance of a rate hike in early May. That’s about as close to a slam dunk as you can get. Fed speakers last week are still hawkish, yesterday’s comments by Atlanta Fed President Bostic says one more and leave rates higher for longer.

Issues/Stocks to Watch This Week

Tech earnings – The first big week of earnings with several releases, we’ll be keeping a close eye on technology names, which have surged in 2023.

Options – Friday is a big options expiration day, and with so much bullishness recently we could see a bit of those gains given back.

Fed Speakers – Notable on Thursday is hawkish Cleveland Fed President Loretta Mester, several more out there this week talking about Fed policy.