The Fuse

Futures are up nicely this morning after a deep selloff overnight.

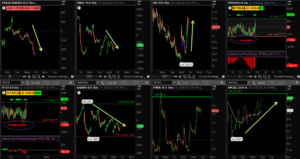

The Russell 2K has been the strong index this week, we are looking to see if the 175 level holds on the IWM. As for the Nasdaq 100, it’s 13K that has been a struggle, we’ll see if that number is exceeded for a weekly close higher.

Not much news overnight but interest rates continue to move lower.

PG and HCA delivered strong earnings this morning, also SLB and FCX posted solid quarters. The latter two names are modestly lower but we’ll see how things go later in the session.

A solid comeback for the bulls yesterday but more pressure today shifts to market to more downside ahead.

Breadth is clinging to a buy signal, but a bad day of breadth here on Thursday will shift this indicator to a sell signal. These are pretty reliable. Oscillators are nearly negative.

Volume trends are weak here, seems buyers are running out of fuel.

We are still watching the 4,200 level on the SPX 500, where we would expect to see major resistance. Further, a drop to 4100 would not be unexpected, but lower than that we have 4050 as an area of interest.

The Internals

What’s it mean?

A shot across the bow, or simply a garden-variety pullback? It certainly felt as if buyers were on strike the last few days, save for some last minute short-covering. The bear market qualities are still in vogue, was a massive drop in the VOLD, a rising put/call and strong pop in the VIX. With options expiration tomorrow for April, plenty of fireworks. A poor close on Friday could be a bad sign to end April.

The Dynamite

Economic Data:

- Friday: Flash PMI

Earnings this week:

- Friday: FCX, HCA, PG, SAP

Fed Watch: Fed tool is now seeing about a 87% chance of a rate hike in early May. That’s about as close to a slam dunk as you can get. Fed speakers last week are still hawkish, yesterday’s comments by Atlanta Fed President Bostic says one more and leave rates higher for longer.

Issues/Stocks to Watch This Week

Tech earnings – The first big week of earnings with several releases, we’ll be keeping a close eye on technology names, which have surged in 2023.

Options – Today is a big options expiration day, and with so much bullishness recently we could see a bit of those gains given back.

Fed Speakers – Boston Fed President Lisa Cook will be talking it up later today.