The Fuse

Equity futures have rolled over following a strong move yesterday and some follow-on buying early. Some heavy sell programs hit overnight and dropped the futures cold, a bit more an 1%. We have to get used to this volatility. Yesterday’s Fed-induced rally was nice but there needs to be more indicators turning bullish.

Interest Rates are moving lower in a safety trade situation. Fear is still out there even as the VIX fell sharply Wednesday. Bonds are holding firm but that may be changing soon as the Fed eases up on quantitative tightening (they’ll be selling fewer bonds). Fed futures now pricing in better odds for two cuts in 2025 rather than three (which was the case last week).

Equity futures have slipped about .4% as a lack of a bid is apparent. STOXX in Europe gained .2% as France and Germany were mixed. The dollar climbed .2%. Crude oil is up slightly while gold is barely negative. German 10 yr bund yields were down 2bps, US 10 yr treasury yields up 1bp. In Asia stocks were lower, in Japan markets were closed while Hong Kong dropped 2.2%, Shanghai down .5%.

Earnings from Five Below were better than expected, the stock up about 10%. This morning we heard from Accenture as they beat by a small margin.

PDD missed on their report. Tonight we hear from FedEx, Nike, Micron and Lennar.

After Tuesday’s drubbing the bulls made a stellar comeback, picking up all of the losses and then some. This rally keeps the market in position to move into higher ground there is some resistance ahead above 5,700. That was a level tested yesterday and rejected, but we’ll give it a few more days to try it again. The technicals are turning bullish but need some momentum to keep it rolling.

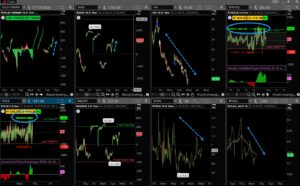

Breadth finished strong following weakness, so we have strong breadth on 3 of the last 4 sessions. As of now the breadth indicator is on a buy signal but it has been flipping back n’ forth for weeks. We have a strong buy signal on the oscillators which are firmly above the zero line, and finally some new highs are beating out new lows in the NYSE, that indicator is now neutral.

Strong turnover as the indices just eked out an accumulation day. Of course, some followthrough today/tomorrow would give that move a bit more stability. Strong volume when the market is moving higher is a bullish sign, we have not had much to hang a star with over the past six weeks, so this post-fed move was a relief to the bulls. Need to walk before you run.

That was some rally, and the bears were raked from the start. Good technicals across the board as it now appears last week’s lows may stick for awhile. Yet, there is plenty of resistance above starting with 5,700 on the SPX 500 which was a meltdown point yesterday. IWM has good resistance at $210 and could be the next spot for small caps to test, the Nasdaq is pushing 20K once again as that level has been tough to mount a rally. Exceeding yesterday’s highs would be huge for the bulls and keep a strong rally moving.

The Internals

What’s it mean?

There is nothing like some stock-friendly words from the Fed to sooth the nerves. Stocks have been butchered recently following the last couple of fed statements but not yesterday. VIX declined sharply as the committee held firm on rates. TICKS were strong all session long and while there were some sell programs we saw the bulls win the day. VOLD and ADD were up and strong but not quite like Monday, we may see that change however in the days ahead. Put/calls finished lower while TRIN stayed low, the market indicators in balance. Great day for the bulls.

The Dynamite

Economic Data:

- Thursday:Jobless Claims, Philly Fed, leading economic indicators, existing home sales

- Friday:N/A

Earnings this week:

- Thursday:PDD, JBL, ASO, ACN, GAMD, DRI, LE, MU, NKE, FDX, PL, LEN LAZR, KLC

- Friday:NIO, CCL

Fed Watch:

The second Fed meeting of 2025 may be a contentious one. Recent readings on inflation (last week) seem to point towards the downward move in prices the committee was hoping for. Yet, we are a long way from feeling comfortable about the trend of inflation. There have been fakeouts along the way, the committee is taking a much more guarded approach to crafting the right policy moves, as they should. Projections come out this week along with a Powell press conference.

Stocks to Watch

VIX = Volatility got a big jolt last week, rising up near 30% before backing off by week’s end. The trend may be down with another drop below 20% but there are still worries about tariffs and the uncertainty about economic growth.

Interest Rates – We have seen rates ticking higher ever so slowly over the past several weeks. This seems to imply a distaste for bonds at the moment, tied into weakness in the dollar, strong gold as well and worries over the US economy. Some of those uncertainties will be understood better this week.

Options – Expiration is this Friday and it is a big one, the triple witching variety. As is custom, rollouts happen about week prior so the effect from expiration is only really felt on volume unless there is a big gamma skew. It’s more or less a media spectacle.