The Fuse

Equity futures are down a bit today reflecting softness in Europe and Asia, which are modestly higher. Volatility is up slightly this morning as more words from Secretary Yellen warning of an ‘event’ if the debt ceiling is not raised.

Interest Rates are lower this morning as the bond rally continues and the curve inverts even more. Yields on the long end of the curve are pointed lower, bonds are becoming more valuable.

Debt ceiling talks will likely resume today, Germany came out with dire predictions of a nasty recession. Home Depot cut its outlook going forward, retail sales will follow later this morning.

Home Depot dropped a bomb with very weak guidance for the coming quarter amid a weaker consumer.

Several conferences are happening this week and starting up in the coming days. We often hear some positive news out of these sessions.

Decent breadth Monday, but we’ll see if that continues into the rest of the week. Plenty of earnings data out including Home Depot this morning and Target tomorrow.

Volume trends were modest as the summer slowdown in turnover continues. Yet, all is not lost, markets continue to push higher with some new highs hitting. Strong performance for the Russell 2K.

Rangebound market is what it is! Until a breakout above 4200 or below 4050 on the SPX 500 happens, we are stuck in a range, bulls are vulnerable to a sizable pullback.

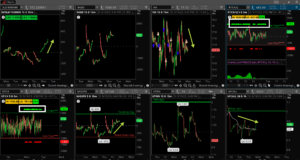

The Internals

What’s it mean?

Solid day for the internals on what was basically a quiet Monday. Stocks started higher but seemed to have slept in from the weekend, but the bulls added to the mix by picking up stocks on the cheap. The VOLD was up all day long but surged end of day as did the ADSPD. Look the ticks, both sides they have really shown more buying strength than anything. VIX trend remains down.

The Dynamite

Economic Data:

- Tuesday: Retail Sales, Industrial production, Business Inventories, NAHB housing market index

- Wednesday: Mortgage Apps, Housing Starts, Crude Inventories

- Thursday: Jobless Claims, Philly Fed Index, Home Sales, Leading Indicators

- Friday:

Earnings this week:

- Tuesday: HD, PSFE, SSYS, KEYS, KD

- Wednesday: JACK, TGT, TJX, CSCO, TTWO

- Thursday: WMS, GOOS, EXP, WMT, AMAT, DECK, FTCH, ROST

- Friday: DE, FL

Fed Watch:

Last week we heard some rather hawkish comments from some prominent Fed speakers. We’ll hear more this coming week as the committee members talk about inflationary trends and the recent price rises as seen through the CPI and PPI.

Stocks to Watch

Tesla – With a new CEO named at Twitter, will Elon Musk revert back to the EV company full time and give them the attention they deserve?

Retail – We’ll have the April retail sales numbers this week but also many retailers report their next quarter earnings (see above).

Gold – the metal pulled back to the 20 ma this week where it should find some support.