The Fuse

Equity futures are up modestly this morning as the markets try to continue this most recent bold rally. Wednesday’s action was simply stunning following a weaker than expected CPI report for April. The SPX 500 tagged a new all-time high along with the Nasdaq, Dow Industrials may not be too far off.

Interest Rates are edging lower again this morning as perhaps the data is leaning toward a looser monetary policy. Of course, the ‘higher for longer’ mantra has been preached by all on the FOMC, and with five speakers today they are likely to reiterate that position. Chances for a July or September rate hike improved slightly.

There is nothing like a new all-time high to get the rest of the world excited about investing. Retail sales for April were rather poor but maybe the consumer is just taking a rest. Stocks in Europe rallied overnight, the dollar is weaker, while gold is slightly down. Stocks in Asia were higher, Japan and Hong Kong both gains about 1.4%.

Strong numbers and guidance last night from Cisco are helping to pace the action in the pre-market. Many tech stocks are bid strong on this report. Baidu and JD.com reported strong earnings this morning, Walmart is out as well and their report was solid. Deere reported a shortfall in revenue. Later tonight we’ll hear from Applied Materials, Take Two and a few other smaller names.

Now that is what I call a bull move! SPX 500 to all-time highs, Nasdaq followed through as well. It was a broad rally, even the Russell 2K was dragged along with it. Given the close proximity to new highs for the SPX 500 it seemed like a slam dunk. The positive response to CPI was also encouraging, retail sales were weak but that meant ‘bad news is good news’.

Solid breadth today as the bulls took control and never let up. As it is with low volatility the buyers just kept coming at this market and took the whooping stick to the bears. Oscillators however are deeply overbought at all time highs for two indices, so there is a bit of conflict here. Yet, breadth is still on a buy signal, and that means dip buyers will be active in this new bull trend.

More heavy volume as the bulls notched one more accumulation day, the market is now officially in an uptrend according to the Investor’s Business Daily (IBD). Strong turnover at all time highs shows buyers have conviction, and boy did they ever! Solid metrics across the board, broad participation around several groups means a followthrough opportunity is upon us.

Not much left to say here as the SPX 500 takes a stroll above 5,300 for the first time. We’ll say support is at the close from Tuesday, around 5,250 or so. Nasdaq has support at 18K while the Industrials may breach a new high later today, Support at 39,450. Quite a stunning move that caught everyone off-guard, but that’s usually the case.

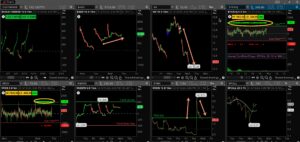

The Internals

What’s it mean?

Just a lopsided win for the bulls yesterday, strong turnover with good breadth and lower volatility. We see the power in this move with the indicators above, the ticks were heavy green all session long, VIX was trounced while the ADD remained firm all day. It was not a trend up day, VOLD was suspiciously low, the TRIN rose up sharply then came crashing down, that was due to more issues up/down vs lower volume early on. Followthrough is important.

The Dynamite

Economic Data:

- Thursday:jobless claims, industrial production, import/export, housing starts/permits

- Friday:Leading indicators

Earnings this week:

- Thursday:WMT, WMS, GOOS, UAA, JD, BIDU, AMAT, FLS, ROST, TTWO

- Friday:

Fed Watch:

Stocks managed to forge ahead this past week after some dueling fed speakers were out Friday. Goolsbee (Chicago) and Kashkari (Minneapolis) were trying to explain their views and were certainly at odds. This coming week has Chair Powell speaking on Tuesday with a slew of other speakers on the schedule. Some more hawkish than others. With some data sprinkled in between, will we see simultaneous responses?

Stocks to Watch

Gold – The yellow metal had a stellar week after a mild corrective period in April. We still see gold making a run to $2,500 eventually, especilly if there is continued worry about sticky inflation.

SPX 500 – New highs are not far away, the last time the index made a run there it fizzled out. This time around, breadth and new highs are strong, so this may be the time to push upward. If 5,265 is exceeded, we see a move to 5,350 pretty quick.

VIX – Once again, the volatility index is quite low and that means the market is complacent about risk. That can last awhile, and in fact a few more days of this will actually cement a market buy signal, if the 20 day moving average of the VIX crosses under the 200 day moving average and confirms. That could happen by Thursday of this week.