The Fuse

Equity futures are higher this morning looking to rebound from yesterday’s late session selling. Volatility is down in what could be setting up as a risk-on day.

Interest Rates are falling a bit as they head towards the lower end of the zone. Without much to spark rate moves other than Fed speak and chatter, it’s all about money flows.

Plenty of fed speak yesterday drove markets down the last 90 minutes.

Home Depot was awful yesterday, but so was Target this morning but that stock may have been washed out. Guidance was atrocious. Later tonight we have Cisco, Take Two and Synopsis.

Several conferences are happening this week and starting up in the coming days. We often hear some positive news out of these sessions.

Breadth was terrible Tuesday as this indicator remains on a sell signal.

Volume was elevated Tuesday as it turned into a day of distribution. That is institutional selling, and with several more of those the market is vulnerable to corrective action.

Rangebound market is what it is! Until a breakout above 4200 or below 4050 on the SPX 500 happens, we are stuck in a range, bulls are vulnerable to a sizable pullback.

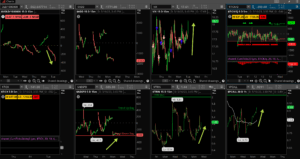

The Internals

What’s it mean?

We knew early by looking at the internals the bulls would be challenged on Tuesday. That indeed happened, and while there was an attempt to go positive the downward influences were just too strong. The VOLD pointed down all session as did the ADD, a complete risk off day. VIX was higher on the session and closed near the highs of the day, put/call is on the rise and ADSPD was nearly a trend down day. Nothing good for the bulls here, but maybe they shake it off today.

The Dynamite

Economic Data:

- Wednesday: Mortgage Apps, Housing Starts, Crude Inventories

- Thursday: Jobless Claims, Philly Fed Index, Home Sales, Leading Indicators

- Friday:

Earnings this week:

- Wednesday: JACK, TGT, TJX, CSCO, TTWO

- Thursday: WMS, GOOS, EXP, WMT, AMAT, DECK, FTCH, ROST

- Friday: DE, FL

Fed Watch:

Some Fed speakers were out yesterday with some pretty hawkish comments, not too surprising. We’ll have three more speakers later in the week.

Stocks to Watch

Tesla – With a new CEO named at Twitter, will Elon Musk revert back to the EV company full time and give them the attention they deserve?

Retail – We’ll have the April retail sales numbers this week but also many retailers report their next quarter earnings (see above).

Gold – the metal pulled back to the 20 ma this week where it should find some support.