The Fuse

Futures are down a bit today as we suspect traders are waiting to see how the Fed positions itself for monetary policy.

Interest Rates are lower today as bond prices continue to soar. The last message of the bond market to the Fed before their meeting is ‘slow down’. Perhaps some of this demand is from a worry about the debt ceiling debate that is starting to shape.

Not much news overnight but Australia did tighten their funds rate overnight. Oil is falling as data from China indicate weaker demand.

Strong earnings this morning from Uber and Pfizer are trying to lift markets. We also saw solid numbers from Marriott.

The Fed has another big meeting this week where they will contemplate monetary policy. We expect to see a hike on Wednesday and possibly one more in June, but it’s the press conference where all of the excitement occurs.

Breadth cooled down a bit Monday but was only mildly negative. This indicator is still on a buy signal.

Volume trends were weaker Monday as the SPX futures stalled out above 4200. Markets need a catalyst to get going higher, and above 4200 for a few days would do it and push buyers in, bringing volume levels upward.

The SPX 500 nearly hit February highs on Monday, and then it backed off. There just wasn’t enough energy to get it through that level this time around. We are watching the 1800 level on the Russell 2K here.

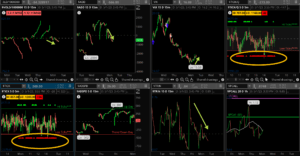

The Internals

What’s it mean?

A day of consolidation and profit taking as the market players await to hear from the Fed this week. Notice the small movement in VOLD and ADD, telling us not much conviction nor establishing an intraday trend. But, ticks were prominent and negative, we’ll see if that spills over to today.

The Dynamite

Economic Data:

- Tuesday: Factory orders and JOLTS data.

- Wednesday: FOMC rate decision, ISM non- manufacturing index,, ADP employment change.

- Thursday: jobless claims, challenger job cuts, productivity and unit labor cost for Q1 2023.

- Friday: NFP labor report, consumer credit.

Earnings this week:

- Tuesday: CMI, DD, ETN, MAR, TREE, TAP, PFE, QSR, UBER, ABNB, CLX, F, SPG, SBUX, YUMC

- Wednesday: BG, CVS, EL, HBI, KHC, YUM, EQIX, FSLY IR, KLIC, NUS QRVO, QCOM SYNA OLED

- Thursday: CAH, SHK, MLM, VMC, K, RACE, ICE, IDCC, AMNY, AAPL, SQ, CRUS, COIN, DASH, DBX, EXPE, FTNT LYFT, SHOP, MIS

- Friday: AMC,. CBOE, CHNI, ROAD, WBD

Fed Watch:

Issues and Stocks to Watch this week:

Apple – Releases earnings on Thursday evening, it may trigger some big market movements.

First of the month – money flows are often strong to start the month.

The Fed meeeting – Plenty of hot inflation data, too much for the committee at this point, looking for another hike or two to come.