The Fuse

Equity futures are bouncing around this morning but with a slight negative bent. Some earnings are out this morning that may give the indices lift, but the stock market is wildly overbought here and ripe for some profit taking. Who knows when that will commence, and likely nobody wants to miss out nor be in when the selling starts. Economic data later this week might tip the scales to the bearish side.

The bond market was closed Monday but is back working its magic today. Yields are up a bit as bond sellers continue their run at selling fixed income. We are seeing very little difference now between fed funds and treasury yields, so a move by the Fed will tip the curve into a more normalized state. The issue is about timing and pace, the market wants this to happen faster than the Fed is willing to commit.

Stocks in Europe fell about 1% on higher turnover, apparently traders across the pond were getting worried about an overheated market. The dollar rose again, about .3% and is on a roll. German 10 yr bunds rose 2bps, treasury yields were strong and rose up 6bps on the 10 yr, we’ll see if 4.5% holds as resistance before the next Fed meeting. Stocks in Asia were down, Japan declined by .4% while Hong Kong shed 2.8% and Shanghai dropped a large 1.4%.

Earnings this am from HD were strong as the company provided solid guidance. Shopify also beat and raised guidance, while SE beat on revenue and earnings. Later tonight earnings from Spotify, Cava, Oxy and Instacart, tomorrow am CyberArk and a few smaller names.

It was all about crypto, bitcoin and small cap stocks on Monday. The ether currency hit new all time highs and simply would not stop running. At this point it appears Bitcoin is on a collision course for 100K, at this pace could be the end of the week. Investors in the crypto space supported Donald Trump’s campaign as he promised to help in the de-regulatory process. That was music to their ears. However, strength was seen elsewhere as breadth was once again positive.

Good breadth on Monday but nothing lights out again, but that does not mean the rally cannot continue onward. Markets are pretty overbought here from a price perspective, the oscillators are also leaning in that direction. Remember, overbought conditions with momentum can run for quite some time. New highs are still crushing new lows, that indicator remains bullish.

Strong turnover as the skew towards crypto currency remains fascinating. Traders are lunging at stocks ‘anything bitcoin’ related, and that puts heavy pressure on volume. That’s quite fine when the market is making new has as it is, even better when the volume broadens out to include other groups as well. Notable strength in the small cap space with Russell 2K higher by a very robust 1.5% on good volume. Let’s see what the rest of the week brings us.

Not much testing of support when you have a runaway bull market. Good solid strength in the indices has this market overbought, the fear/greed index now flashing greed. It now becomes a game of musical chairs, when the music stops you need a seat to be open behind you, which means you should have some cash available when the dips occur. There WILL be pullbacks, some sharp and others mild but be sure you’re ready when they come.

The Internals

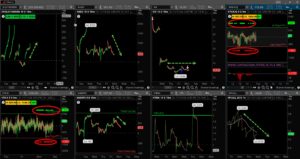

What’s it mean?

Another mixed picture with the indicators Monday. VOLD was pretty strong but still well below levels it closed at last week, while the ADD is back its old ways of opening highs and selling off the remainder of the day. VIX was muted while ticks were spread rather evenly, buyers early in the day and sellers towards the close. Put/calls were again notably lower.

The Dynamite

Economic Data:

- Tuesday:NFIB optimism index, three fed speakers

- Wednesday:CPI, Four fed speakers

- Thursday:Jobless claims, PPI, Fed speakers (including Chair Powell)

- Friday:Import prices, Empire State Manufacturing, Retails sales, industrial production, cap utilization, NYF President John Williams

Earnings this week:

- Tuesday:AZN, HD, IAC, MOS, SGRY, THS, TSN, SWKS, RXT, SPOT, CAVA, SOUN, OXY

- Wednesday:CYBR, BZH, CSCO

- Thursday:DIS, AMAT. POST, JD, AAP

- Friday:BABA, BKE, FL

Fed Watch:

The committee delivered a big rate cut last week, and now the market is focused on December. The futures market sees a strong possibility of this happening, but the data is going to need to come in as hoped for. This is a huge week for Fed speakers, and Chair Powell will be heard as well along with some other important names. Interesting they are all coming up with some important inflation data.

Stocks to Watch

Nasdaq – New highs for this index as it is now taking taking the lead. Remember in 2023 this index was up 53%. That is not likely achievable again but having the power to bring the other markets up is a huge advantage.

Tesla – After the election results, Elon Musk’s company really stepped on the gas and moved higher. The all-time highs are about 30% away but this stock has incredible momentum and could certainly make a run there before year end.

Inflation – With CPI and PPI readings due out this week, the expectations are for the core to continue dropping. The Fed has made great progress in bringing down prices but more work is needed. Policy is still restrictive, but with better inflation numbers the committee will bring rates down faster.