The Fuse

There is nothing like a followthrough day to confirm your suspicions of a new trend. That big reversal day Wednesday was very important but more crucial was a followthrough day yesterday. That happened, and futures continue to push forward, rising up as the SPX 500 trudges slowly towards the all-time highs back in July.

Interest Rates are turning down as bond buyers are back to add some yield to their portfolios. The 2 year yield remains under pressure, closing again under 3.7%. This yield is aggressively pricing in future rate cuts and more than likely expecting the Fed to front load the cuts or take a more aggressive stance. They are unlikely to do this however. Fed futures see 4 1/2 cuts happening in 2024, which is far ahead of where the committee sees policy.

Another strong day for the indices yesterday influenced markets overseas, the European Stoxx were up about .5%, the dollar dropped but gold continues to shine, pushing right near $2,600 per ounce. Silver is also on the rise as is crude oil, looking to tag the $70 per barrel level again. Japan was off on profit taking while the Hang Seng rose but Shanghai fell about .5%.

Earnings from Adobe were strong but not good enough, guidance a bit light as the stock is getting pounded this morning. RH beat on the top/bottom line and is ripping higher today.

The bulls got their wish and had some solid followthrough, and now the only impediment for the SPX 500 is the old highs. It won’t be easy but with strength in overseas markets and a likely shift to rate cuts it will be hard to contain the bulls’ enthusiasm. The price action has been stellar this week and while we did see a large drop Wednesday, that reversal is monumental, as the low at 5,400 is going to remain firm.

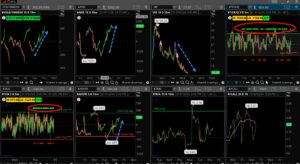

That was quite the day for breadth, a 3-1 rout for the bulls that started off slow but managed to really push the limits by end of day. Oscillators are back in positive territory, new highs continue to crush new lows. That sort of ‘under the hood’ action is going to carry this market to overbought, which will eventually be new highs.

Good day for the markets to followthrough as we mentioned yesterday, the SPX 500 has now moved nearly 190 points in less than two full sessions. The buying was brisk after the noon lunch hour as volatility declined with the rising stock market. We did see quite a bit of option volume, likely to square up and prepare for next Friday’s big option expiration (Sep 20).

That 5,400 level from Wednesday will go down as very strong support for the SPX 500, while the Nasdaq sees the same 18.5K. It is not common to see such a sharp turnaround intraday but with good followthrough yesterday it becomes meaningful. The Industrials have good support at 40,400 and are within 1% of all-time highs. This being Friday, the action could go either way but if there is a nice bid today new highs could be seen in the SPX 500 and the Industrials by days end.

The Internals

What’s it mean?

Another strong day for the internals, the VOLD pushing up strong all day to finish at its highs, while the ADD was particularly strong. VIX fell sharply as it does when news is released, this time the PPI at the start of the day. Ticks were heavily green as well, strong buy programs were particularly strong at the end of the day. This bodes well for more upside today.

The Dynamite

Economic Data:

- Friday:Import prices, consumer sentiment

Earnings this week:

- Friday:N/A

Fed Watch:

No fedspeak this week, the committee is in their quiet period before next week’s crucial meeting. The data this past week still shows the economy is chugging along at a moderate pace, though some metrics in the labor report see chinks in the armor. A few fed speakers during the week stated the committee is ready to commence with a rate cutting policy which in our view will last quite awhile as the FOMC looks to reduce the tight conditions that have existed for a couple of years.

Stocks to Watch

Apple – A big event is scheduled for this week, but recent weakness in the stock means there has been little excitement to buy Apple. Can that sentiment turn around or will this new iPhone introduction (likely) be another excuse to do more selling.

Inflation – In Jackson Hole we heard Chair Powell declare the time had come for rate cuts to start. That of course could start next week, but there are still important inflation reports to consider this week. Will the CPI confirm the Fed’s view that inflation is right near target?

Nasdaq – It was the worst week in a year for stocks, the Nasdaq took the brunt of the punishment. Can it recover or will we see another lower higher, lower low in the weekly chart? The 50 week moving average is not far down from here, about 800 points which can be tagged easily with elevated volatility (currently).