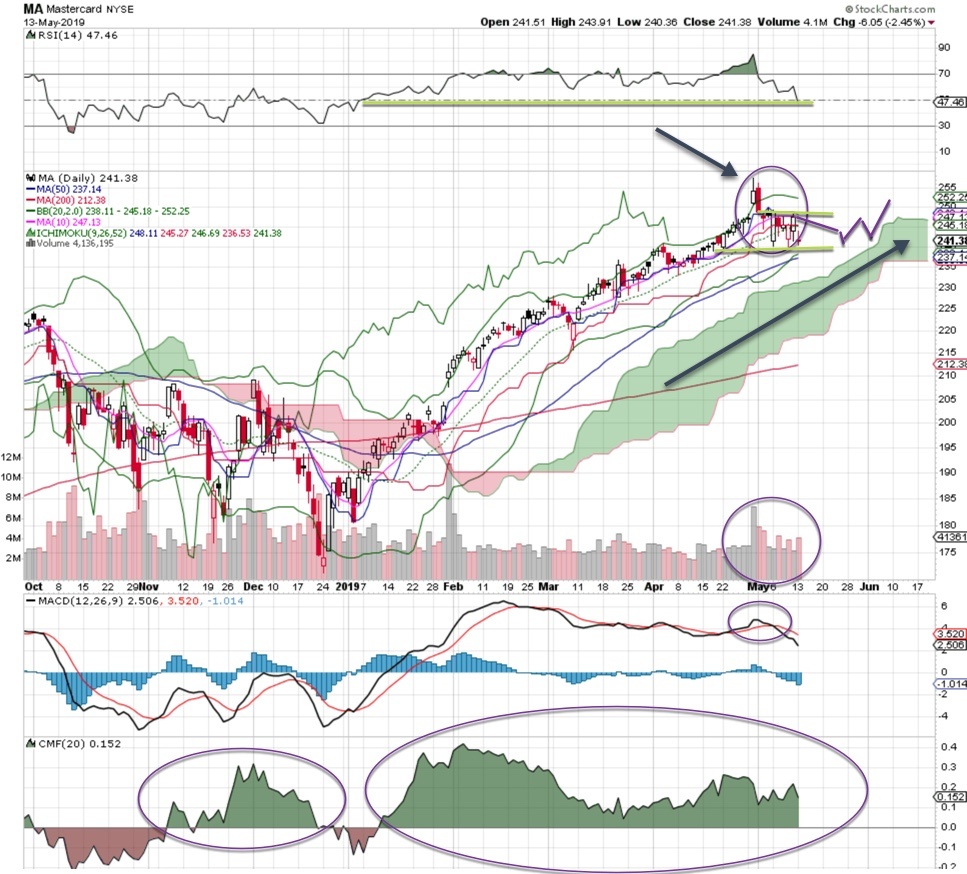

With the markets getting pounded lately, I am looking at the names that have held up. MasterCard is one of them. While the stock has endured some selling this past week, it appears to be contained. The chart shows a better consolidation than its competitors (Visa and American Express).

Money flows have been very positive, though recent volume trends are bearish. MACD is on a sell signal, but it looks like it’s corrective. If the 240 level holds here, we could see this stock eventually make a run past the old highs (around 257). That will only happen when/if the market turns around.

Take a deeper dive into MasterCard chart action (NYSE: MA) and learn how to read the technicals. Get Bob Lang’s full analysis as he marks up our chart of the week.

Love what you’re learning in our market analysis? Don’t miss a single video! Get the latest chart action delivered directly to your inbox every week as Bob breaks down stocks to watch and potential trade options!

About MasterCard (MA)

MasterCard provides transaction processing and other payment-related products and services in the United States and internationally. The company was founded in 1966 and is headquartered in Purchase, New York.