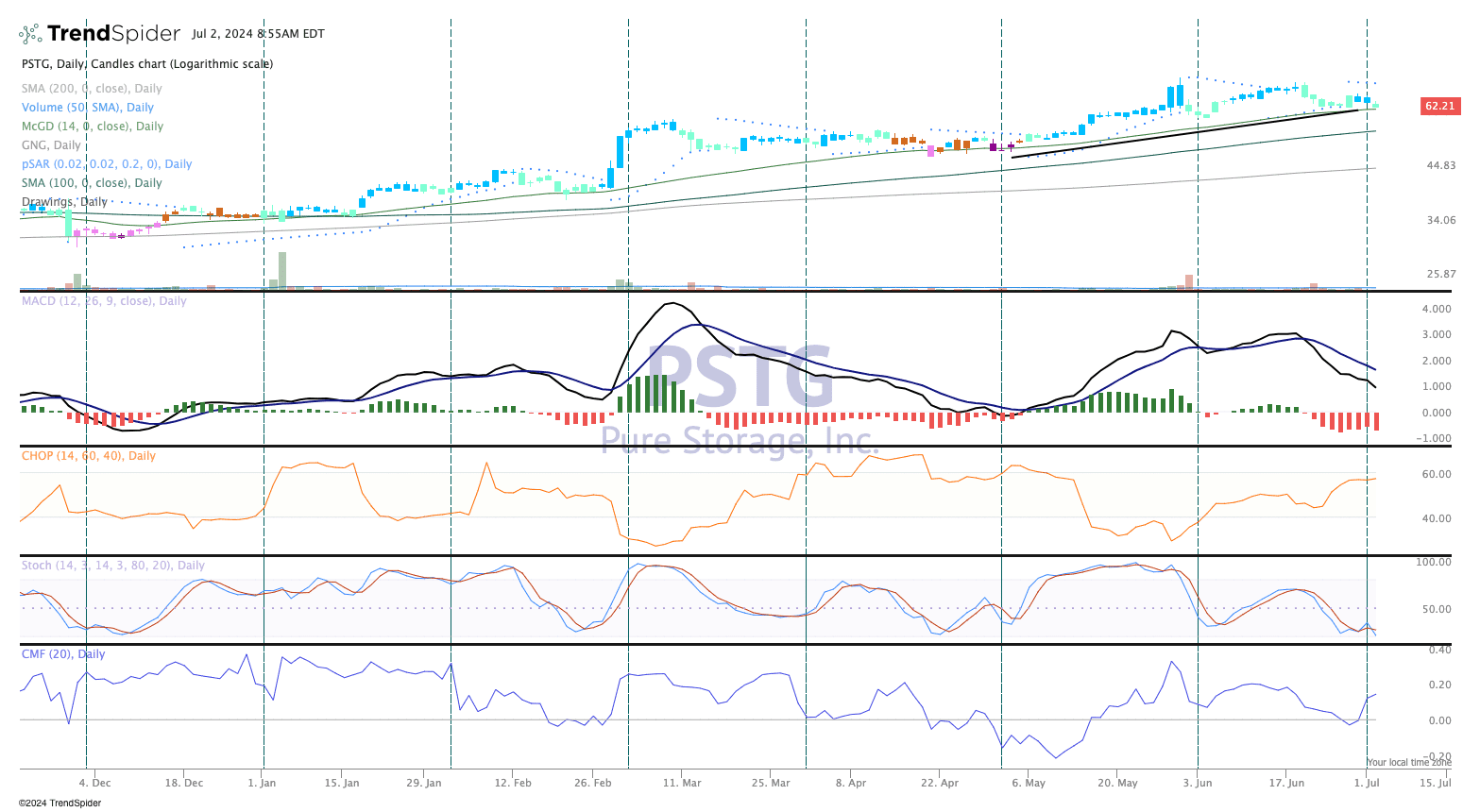

Chart of the Week: Pure Storage

It’s time for our chart of the week and this week we’re gonna be focused on a new name here called, Pure Storage. PSTG is the symbol. Let’s take a look at this one and see what we can figure out here.

As you can see from back earlier in the year, we had this huge monster move up at the end of February and beginning of March. Looks like it was earnings driven and the stock bolted higher in a just a couple of days.

The stock has been in consolidation

And it pretty much went consolidated for a little while, and then it made another large move from April and a couple of big days at the end of May. Now it’s kind of consolidating again. We think that after this consolidation period this is the time you really want to get long the stock.

We see that the candles over here are pretty much bullish. When you see the go-no-go indicator, which is the color candles. Blue or teal indicates bullish. Blue is full-on bullish. Teal, the green candles, is more cautiously bullish.

Now the indicators below don’t really align with the bullish thesis at this point right now.

Indicators are improving while price action is bullish

We do see some improvement. We see the chop indicator starting to improve here.

Stochastics have pretty much gotten oversold here. And we know the last time we got oversold here, we went sideways for a little bit at the middle to the end of April before a nice launch higher.

Money flow is starting to improve. MACD is still on a sell signal. And the parabolic SAR, which is the dots on the top of the chart, are still bearish right now.

Again, we have to look at the price action here. And the price action is bullish, because it’s showing us on that composite of go-no-go indicators that the trend is still in place, still bullish.

We have a series of higher highs and higher lows, which is our textbook definition of an uptrend. We think that the stock has got some room, maybe up towards $70. It’s about $62 right now.

Take a look at Pure Storage (see the chart below). It’s a tech name. Again, it got an upgrade recently and pushed higher post-earnings, and we think when earnings come out in August, the stock is poised for another move up.

Don’t miss a single one of Bob’s charts! Get the Chart of the Week in your inbox every week!