As an options trader who uses technical analysis, one of the first things you probably learned is that volume is key. That’s only part of the story. Volume is measured by both volume levels and volume trends. Together with price action (our other leading indicator), they will help you determine market trends and direction.

How to use volume levels and trends

I look at volume prints on a raw and accumulative basis. Strong volume prints (three to five times higher than normal) indicate heavy institutional buying or selling. I then look at price action to confirm. If volume and price are aligned, then a new trend is being established. I can piggy-back onto the trend and place a trade.

I also look for an accumulation of volume days. A series of low volume prints with higher prices raises a red flag. But toss in a strong turnover day with a price breakout, and I’m much more likely to dismiss the prior low volume prints.

Two great examples of using volume to guide your trades

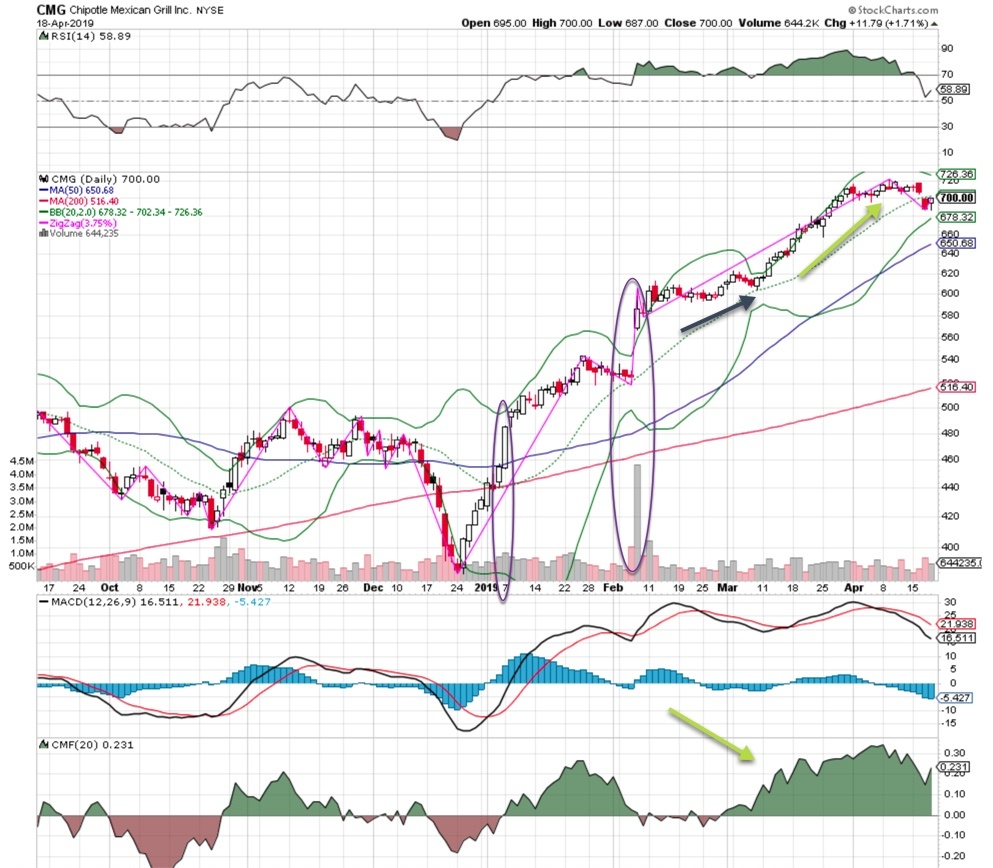

Chipotle showed strong volume with good price action in January, but things really heated up post-earnings in February. The stock made a massive move higher. Also notice the increase in money flow after its next move higher (green arrow).

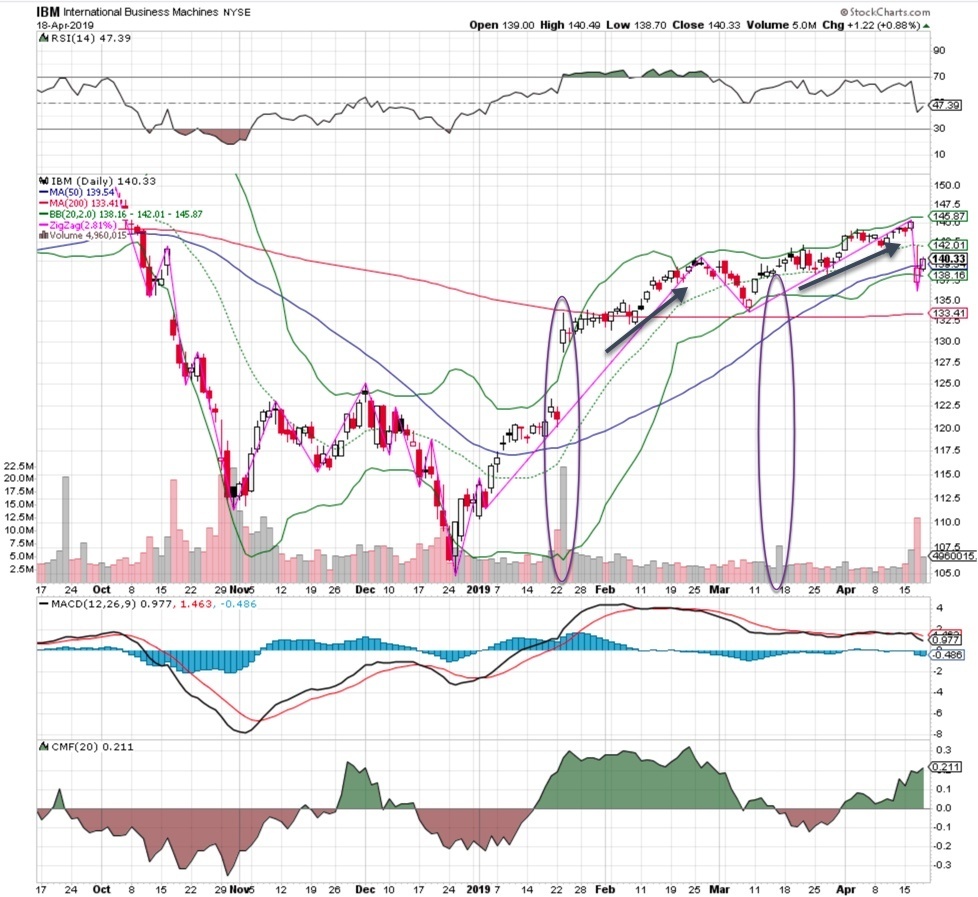

As for IBM, the post-earnings jump in January was on spectacular volume. The follow-on move was even more impressive and led the stock into recent highs.

Volume won’t always be this strong, especially when the markets are near their highest levels. In fact, volume is often lacking as investors take a break and wait for the inevitable pullback. That’s not the best approach, because low volume may just indicate a brief pause before the next move higher. Investors who wait might get stuck waiting for that pullback – which may come after a move up to higher prices.

As Jim Cramer says, volume is like a polygraph test, because there’s no lying about where the money is flowing. But just to be on the safe side, use breadth indicators, the McClellan Oscillator, the summation index and new highs/new lows to confirm volume trends. Then trade accordingly.