To the right is a chart of GDP with a standard high to low Fibonacci drawing applied. Since breaking down from a double top in October, it has fallen a staggering 48%, and it now appears to be in the final stages of putting in a bottom. Getting to a bottom is a processes, and this one is 3 months into formation. Some might look at this chart and say, ‘It is a broken stock.’ I look at it and see massive opportunity!

When you look at the chart, you can see that price has made a higher low, a positive for the bulls. MACD is stair-stepping up and RSI is improving. These are all bullish technical developments. More importantly, GDP showed strong character, gaining 8.10% on Friday while the S&P declined -.65%.

What really has me interested, though, is the short interest in the stock. If you have a stock with a high short interest, and it is trying to put in a bottom or giving reversal signals, traders are likely to try to cover their shorts. To cover a short, you have to buy back the stock, and the simple act of buying back your stock creates extra volatility in the name. As more stock is purchased, the price of the stock rises in response to the extra demand. This can cause dramatic price swings to the upside, as trapped shorts are forced to cover their positions at market. This is known as a short squeeze, and the power of these moves are breathtaking and spectacular.

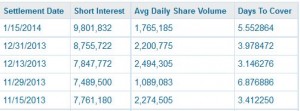

This is the grid of the short cover days for GDP:

Notice that short interest declined in November and December but is once again near all time highs. This time it has improving technicals behind it. Based on this information, it would take 5.5 full trading days of nothing but buying – NO SELLING – to clear the short interest in this stock. As we know, it takes both buyers and sellers to make a market. The days to cover would actually be higher, which gives us additional time for this swing trade. The opportunity for a massive short squeeze is presenting itself right here and now.

Notice that short interest declined in November and December but is once again near all time highs. This time it has improving technicals behind it. Based on this information, it would take 5.5 full trading days of nothing but buying – NO SELLING – to clear the short interest in this stock. As we know, it takes both buyers and sellers to make a market. The days to cover would actually be higher, which gives us additional time for this swing trade. The opportunity for a massive short squeeze is presenting itself right here and now.

The last time we were in this same scenario, the result was a 150% gain in the stock price.

I like a variety of strategies for this trade. For those purely interested in capturing premium, I like the short put option. I would sell the June 17.50 puts naked for a $3 or better credit. This method would obligate you to take 100 shares of stock for each contract sold, so remember to only sell the same quantity of puts that you would want to own the same quantity of shares. (If you want 1,000 shares you could sell 10 contracts.) If you are assigned the stock, you simply turn it into a covered call strategy and sell upside calls against the common shares assigned to you. The goal of this trade is for the puts to expire worthless (or for an 80% gain, whichever comes first). Your return on investment would be 17%. Try getting that from a bank!

A less capital intensive strategy would be to sell a bull put spread. If you go this route, I like the March 15/10 bull put spread for a credit of .80 or better. Your risk is defined to the spread, $5 less the credit received. You can be a little more aggressive in your position sizing, plus time decay will work quickly in your favor. The goal on this trade is for the put spread to expire worthless; your return on investment would be 16%.

As $20 is pretty firmly established as resistance right now, my final approach would be to purchase the stock here and now, place a $1 trailing stop on the equity, wait for price to rise to congestion/resistance at $20, and sell the March 20 calls against your common for income. The goal on this trade is to collect income while waiting on a breakout. Your risk is defined at $1 on the equity at entry, and your upside potential is capped at $20. Depending on what you get for the calls when you sell them, you could reasonably expect a $5 gain per contract, or a 29% return on investment.

Respect the power of a short squeeze, be patient, and your portfolio will reap the rewards.

Interested in getting more strategies like this every day? Please join our chat room, the Explosive Options Pro Room, and trade with me in real time every day! Bob Lang, other traders, and I present ideas using multiple strategies, and we help customize your trading style to your portfolio. If you have any questions or comments, please leave them below!

I am interested in investing in options but I know nothing about them and I work all day and have little time to watch them. Does this disqualify me from this type of investing?