As a technician, I use several indicators every day to guide my trading. My goal is simple: I want to have a firm handle on price action, volume, and market direction. There are many indicators to choose from, and for a new trader, the options can be overwhelming. However, you only need a select few.

Here are the indicators I use to gauge market direction:

Sentiment Polls

Sentiment polls are a quick and easy way to see where money is going – or at least talked about. They are often good as contrarian indicators, but when they are trending, it is not safe to bet against the tide. Polls are quite arbitrary and fickle, which is why politicians rely on continuous polling. It’s the only way to keep up with what people are saying.

Likewise, markets change direction swiftly and with force, hence sentiment polls often shift on a dime. We don’t have to look far for an example. Back on September 29, it appeared the stock market was heading down into the abyss; sentiment polls were in very bearish territory, from the AAII poll to the Institutional Investor poll and various blogger polls. These investor polls had been flashing red for weeks, but at this point, sentiment was washed out. When the market turned days later, bulls came out in force.

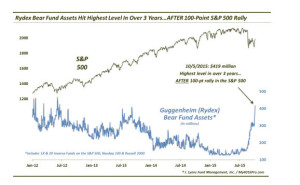

Rydex Ratio

The Rydex Ratio is a great long term tool that measures the flow of money into bullish vs bearish funds. This is a raw  number that can lag and show extreme readings in trending markets. When more money is flowing into bullish funds, the ratio drops; when money flows into bearish funds, the ratio increases.

number that can lag and show extreme readings in trending markets. When more money is flowing into bullish funds, the ratio drops; when money flows into bearish funds, the ratio increases.

From 2012 until this summer, the ratio was extremely bullish (see the chart from Dana Lyons). This normally serves as a contrarian indicator, yet the ratio started to rise sharply in early October when the market bottomed out (at the time, we didn’t know it was a bottom). Lesson learned: When traders are extremely bearish, go bullish.

Short Interest Figures

Short interest figures can be used with the Rydex Ratio. When the crowd is shorting stocks heavily, change is likely to happen soon. There are many reasons to short stocks, such as hedging and convertible arbitrage, but when the short interest starts hitting historically high numbers, use it as a contrarian indicator. That moment of height is when the markets generally turn; this happened recently on October 2 when short interest peaked.

Price and volume are the key drivers to analyzing charts, but polls, flow and short interest are also valuable pieces of information. Analyze them carefully and often to stay on top of market direction – and the right side of a trend.

Image copyright: steverts / 123RF Stock Photo