When it comes to creating an accurate market forecast, I always think of this quote:

Give ’em a number or give ’em a date, but don’t ever give ’em both.

This fantastic advice is from Howard Simons who is known for his “Iron Law” of forecasting (for economists). Putting together a market forecast is incredibly easy to get wrong. Because you don’t have crystal ball, you can go back and forth, from hero to zero, several times. Eventually you might be right. The key is to nail your time frames.

How to create an accurate market forecast

Once you know your time frame, you can drill down and find the characteristics that may define the market’s next move(s). You can determine market direction for just about any time frame, but your experiences with trends and patterns helps with accuracy. Analyze trends and patterns to form an opinion about future prices, and you have your market forecast.

Suffice it to say, creating a market forecast is difficult. To make sure your time frame leads the way (rather than leads you astray), you must understand the expectations for a potential move within your time frame. Hence, your analysis is critical.

For example, a 15 minute chart of a stock or index will give you a completely different read than a daily chart. A weekly or monthly chart will also give you contradictory data. Unfortunately, this is a common occurrence in equity stock charts, especially when the market is choppy or in a bear phase.

However, sometimes charts across different time frames are in agreement.

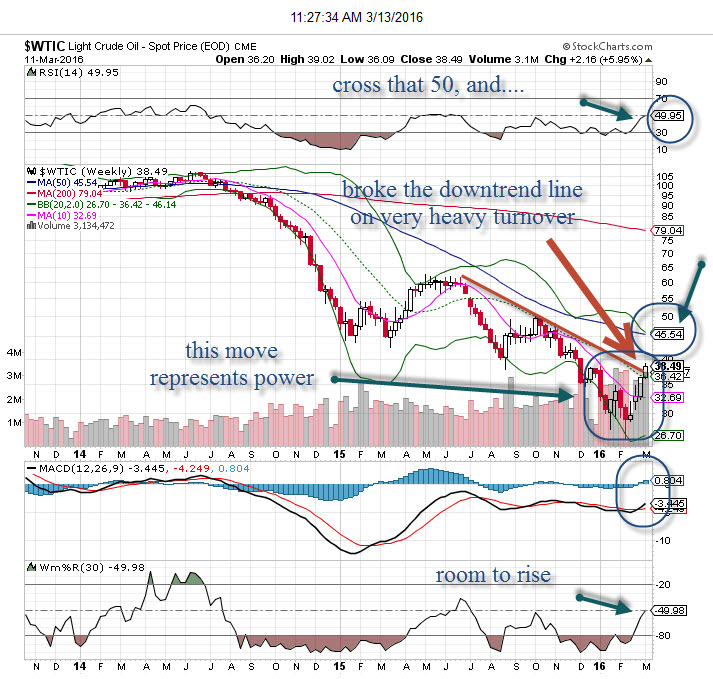

Take a look at the charts for crude oil. Above we have the weekly chart and below we have the monthly chart.

The monthly chart shows a bullish “morningstar” pattern emerging. It won’t be confirmed for another six weeks, so you cannot put this chart in the bullish camp yet.

The weekly chart is definitely bullish. It is forecasting higher prices ahead, extending out toward the $43-$45 level. This may take several weeks to play out, and at that point, the monthly chart may be confirmed. This is valuable information and can be played with a high degree of reliability based on previous data points and probabilities.

Again, the key is knowing your time frames, digging into trends and patterns, and using your experience to create an accurate market forecast.

Updated on May 11, 2023.

Copyright: anaken2012 / 123RF Stock Photo