When the markets (eventually) drop severely, nobody wants to be left holding the bag – who would? While the global economic collapse in 2008/09 is still very fresh in our minds, we have to recognize that that event was an outlier. Yes, the pain was REAL and felt across the investment world, but even with the SPX up 200% from those deep lows in March 2009, there has been hesitancy along the way.

That hesitancy has worsened, and today, I feel that everyone is on edge. As the Fed shifts into a new control phase of less accommodation and higher interest rates (a hawkish posture), we still have investors and traders trying to squeeze out gains before the upward trend reverses. Traders’ options trading strategies are going haywire.

There’s no need to panic. Who will tell us when the trends are going to change? The pundits, experts and gurus who seem to ALWAYS tells us the exact wrong time? Of course not! The MARKET always tells us. The assumption is that the markets will turn down as the Fed removes their stimulus, which has been in place for nearly five years. Yet, I would argue that while this action is hawkish, it is not necessarily the death of equities (as some would believe).

Are stock market gains the result of aggressive Fed policy? I would say yes – for the most part – but then corporate profits are at record highs. That may be the result of easy money, but businesses still have to PERFORM, which is exactly what has taken place.

The Fed easy money policy was as much a psychological crutch as an actual stimulus. Chair Yellen and former Chair Bernanke have both said several times that monetary policy is not a driver of growth. They always stopped short of saying it was a psychological tool meant to create a positive environment and shore up confidence, but clearly, policy has had an effect on the mindset of investors and traders.

As for the market’s next move? I defer to the charts and technicals for the answer, as they guide me and keep me focused on the message of the markets.

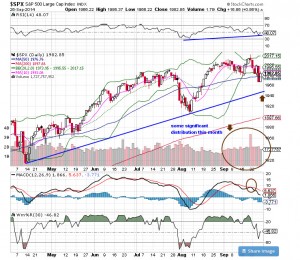

On the SPX chart, we see the potential formation of a top on September 19 with some confirmation to the downside, but that seems only corrective in nature. Further, the trend line is still intact, but it falls down to about 1950, an area of fibonacci support and the 100 ma (an area the markets tested this year and bounced sharply).

Distribution has been high. You can see institutional selling by the high volume bars on down days, but the market always catches its footing. We’ve seen potential tops and top calls on numerous occasions fail – this bull market has fooled so many.

What will I do? I am going to stick to one of my tried-and-true options trading strategies? I will follow the trends and patterns that have worked in the past, and I will continue to follow the lead of the markets.