Remember that shocking moment four years ago when ratings agencies had the gall to downgrade the US debt rating from AAA to AA? It felt like the “shot heard round the world” as other countries sat up and took notice.

The reason for the downgrade was more political than anything else, of course. The debt ceiling crisis was blamed, and so was the lack of a plan by Congress and the President to deal with the burgeoning debt. The ratings agencies weren’t buying another “kick the can down the road” approach, which had been the modus operandi of prior administrations.

You may not know it, but credit ratings have been issued since 1860. The US had always boasted a AAA rating. There was never a doubt in anyone’s mind that we could pay our bills. The debt downgrade was a dark and embarrassing day for our proud country, but it wasn’t a surprise. Ratings agencies had warned about a downgrade just four months earlier, but the disagreements between our politicians seemed to force their hand to make a move. (Today our debt is still rated AA, though a couple of agencies have changed their view from negative to stable.)

The downgrade was issued on Friday, August 5 after the market closed. The media gobbled up this news quickly and began trumpeting frightening statements about the consequences. As is custom, the rush to get the news out first was more important than getting the story right or applying a critical eye. Some said interest rates would skyrocket, others said consumer loans would be harder to get and bank earnings would suffer. Some even surmised the dollar would collapse and be replaced as the world’s reserve currency.

They were all wrong.

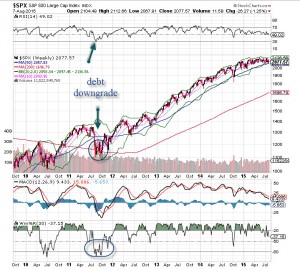

The stock market? It was suffering from a dose of high volatility following the tsunami of doomsday scenarios, and pundits were quick to jump on the bandwagon: “A test of the 2009 lows is imminent! The rest of 2011 is essentially over! Put your money under your mattress because the outcome of this outrageous downgrade has yet to be felt!” That’s all we heard that weekend and the weeks to follow, but that is certainly NOT how it played out.

Interest rates actually fell following the downgrade, peaking in early 2014 at 3% on the ten year bond before falling. Today that bond yields about 2.1%, which is not much higher than it was in August 2011 when yields were 1.6%. Likewise, the S&P 500 was about 1,100 in August 2011, and it is up more than 90% over those past four years. Bank profits are really strong; they have never been positioned better.

How about the US dollar? It’s now the strongest currency out there. Investors are reaching for it as the rest of the world cheapens their own sovereign currency with easing-related policies.

Further, Fed Chairman Ben Bernanke showed little concern about the debt downgrade. The Fed continued the quantitative easing program, and it continued to buy US bonds. This bold attitude showed that Chairman Bernanke had confidence in the economy, and that it would not only grow but also eventually pay back its debts.

Unfortunately, we still have growing debt today – nearly $18 trillion and counting. At some point, the rubber band will stretch too far and snap. It seems that the only solution is to use revenue (taxes) to repay the debt (I realize it is far more complicated than this, but for simplistic reasons, humor me). What a concept: Pay the bills you accumulate. But is it even possible anymore?