We have experienced a very strong move for stocks in this first half of 2023. So much so that it’s almost time to declare the bull market is back. And that means dusting off your bull market strategy.

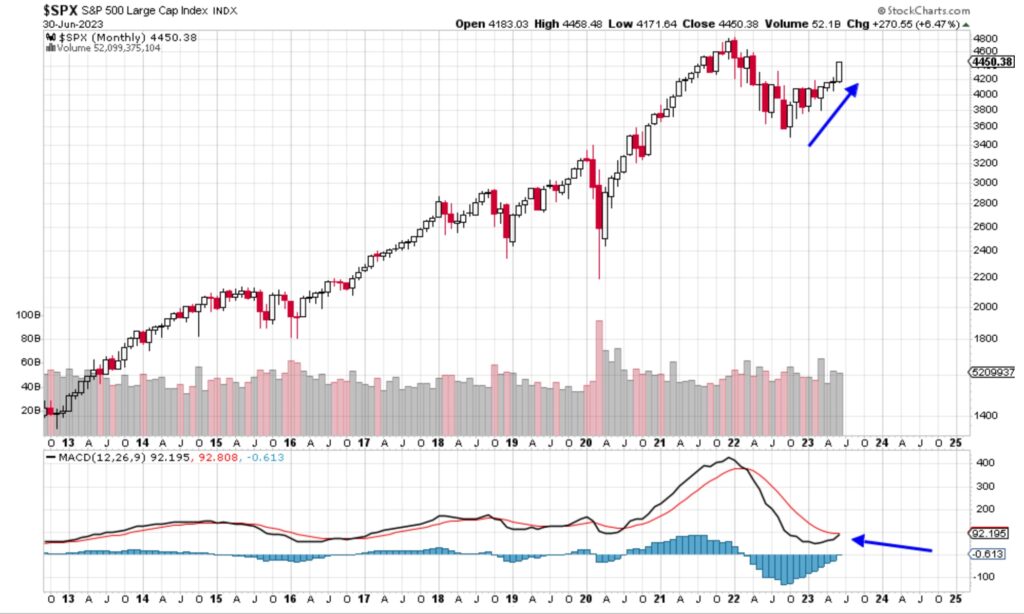

We are not there yet, though. We first need to see a bullish crossover of the MACD on the monthly SPX 500 chart. As you might expect, indicators do not move quickly on a monthly chart.

The daily chart is quite a bit noisier than the weekly or monthly chart, so MACD movements happen frequently. But I have found in my years of technical study that the this crossover is a reliable indication of bull or bear market conditions. You can see the crossover move in the chart below.

As you can see in the chart above, the crossover is happening, but has not been confirmed yet. We might need another month or two to feel comfortable saying that we’re in a bull market. It’ll be a relief to be out of this 18 month-long bear market, won’t it?

So, back to the bull market strategy. You might need a refresher, so here goes:

Your bull market strategy

Much like a bear market you need to have cash handy and some protection working (using index put options) at all times. The biggest difference between a bull and bear market is the aggressive dip buying that takes place during a bull market – especially when volatility is low.

Further, making trading mistakes during a bull market isn’t as painful. With that said, I hope we all learned what can happen when making mistakes during a bear market. Perhaps we will be more cautious during a new bull market.

In the end, bull and bear markets offer opportunities to win on both sides of the trade. Just be aware of the market conditions at the time and only be very aggressive when the landscape is suitable. That time may be coming soon.