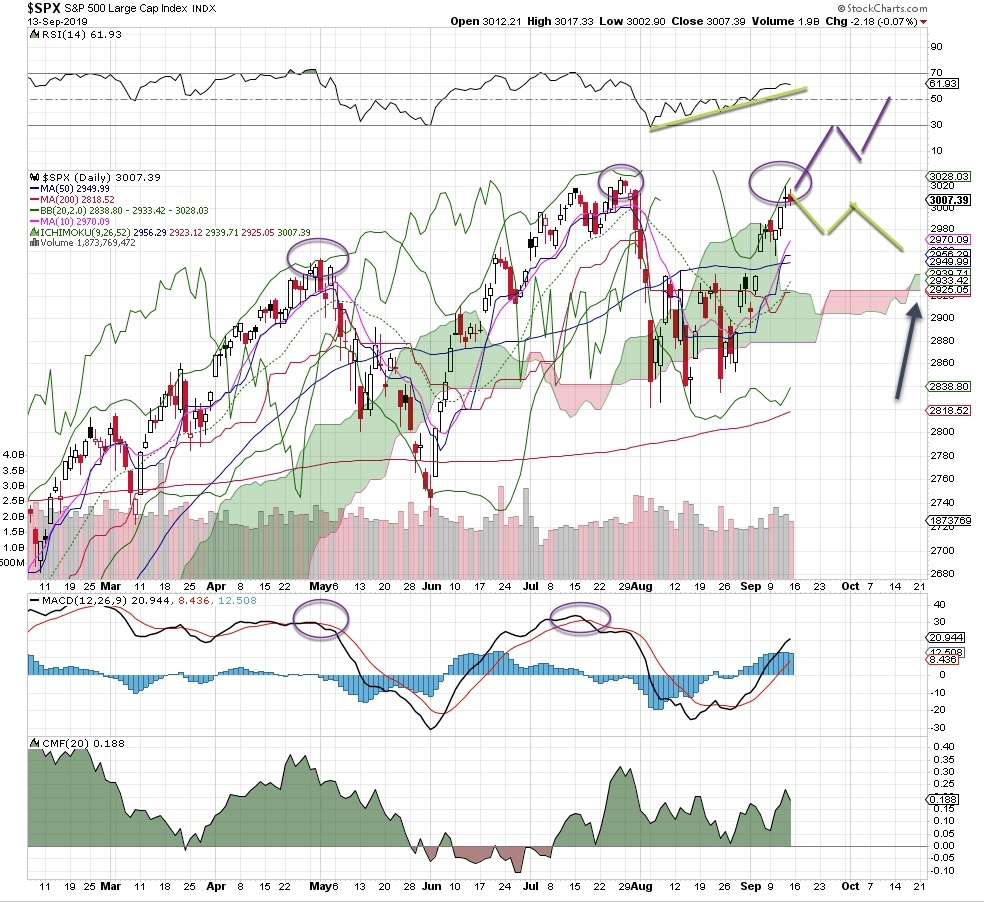

If the current state of the markets has left you with a sense of “deja vu”, you are not alone. Just look at the SPX 500 chart (below). The index just moved higher following a dismal August, and it once again sits near all-time highs. In July, the same thing happened. Then a series of tweets hit, and the markets had a meltdown.

Are we about to go through that again, or will we somehow avoid it?

I wish I knew the answer. One thing I do know is that markets are reacting swiftly to news. That creates a tough trading environment at a time when fundamental data is coming in mixed. Manufacturing and industrial sectors are struggling and energy is languishing. Banks recently had a nice run, but it faces challenges as the economic forecast isn’t strong.

Current State of the Markets

The recent run higher mostly happened during overnight trading sessions. Those sessions were marked by big gap moves up (and a few down), activity that provided traders with precious few chances to jump in. Market indices now sit 6% higher than their lows in August.

Indicators have certainly improved since the middle of August. RSI is steep and rising, the MACD is on a strong buy signal and the cloud has just twisted green. Volatility is low, which indicates heavy complacency, and sentiment is bullish.

Speaking of complacency, take a look at the late April/early May period when markets were at all time-highs. Back then, the VIX was also sporting a very low reading in the 12 area (only slightly lower than the current reading). A few sharp moves up in volatility and the markets were pounded. They dropped down 9% or so in a month.

How to trade this market

Use caution here, especially as the positive news flow starts to thin out. The Fed is meeting this week, and any good news they share may already be baked into stock prices. A rough tweet, sour tone from the US-China trade talks or any escalation in attacks among Saudi Arabia, Iran and Yemen could mean another retreat from these highs.

My advice: buy index puts as protection if you haven’t already. It may seem like a waste of money, but they can absolutely protect your portfolio the next time markets drop with a thud.