I often find myself repeating this message, and I have found that the more I do, the more it sinks in, so forgive me for repeating myself.

The noise is getting louder out there, and it could be quite harmful if you listen to it.

Why? Because the future is so uncertain. When we have the media, pundits, experts, and analysts all claiming they can predict the next move – well, I just have to turn down the volume. Repeat after me:

The markets will ALWAYS tell us the next move.

It is important to embrace this message and listen to the markets now more than ever, because so much is coming down the pike that could seemingly derail this market. I will never try to predict or anticipate what will happen with the markets. I’ll leave that to the market timers who are like broken clocks (they are right twice a day).

Traders are struggling with the length of this bull market – 5 years and counting – and there is fear of getting hit hard when the market turns. The devastating financial crisis is still fresh in everyone’s mind.

Remember 2007? We hit all-time highs during a period of great vulnerability, and very few people saw the warning signs. Fixes and corrections were made to the banking/lending system to prevent a repeat, but you never really know if they’ll work til it’s too late (that’s a story for another day).

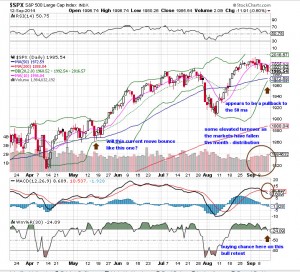

So, currently we have a market that exceeded some extreme levels in price action, hung around for a bit, and after a fantastic August, it is correcting in price and time. That’s not a bad situation, and it gives some traders a chance to set up for a big end-of-year run (see chart below).

With the talk of all the events coming up – the Fed meeting, the Alibaba IPO – we still have an economy that is growing modestly with little inflation. Productivity is strong, consumer sales are increasing, and banks have started to lend again. Housing is still a drag on the economy, but after a tremendous month, isn’t the market entitled to a rest? Does a down week or month mean we should stick a fork in it? Of course not!

As for sentiment, worries still abound on the numerous geopolitical crises across the globe, but unless you are using that as an excuse to sell, there is not much to be done. (It’s important to note that every time the market had come down following news from overseas, it quickly rebounded. That seems to have changed now, because when news hits, the market doesn’t blink). After reaching some pretty negative extremes a month ago, sentiment has become much more sanguine. The market structure is still healthy, though a bit wobbly, after a few distribution days.

We’ll have to see how things shake out the rest of the month, but for now, players are showing some caution – and when that wall of worry is up, it means we could go higher. Listen to the markets. They’ll tell you what to do.