One need look no further than the Fed Funds Futures market, an efficient and very accurate tool for predicting when and by how much rate hikes will occur. Fed officials are monetarists but they also believe in free markets, hence they will certainly look at this for guidance on market expectations. After all, why shock the markets in a negative way?

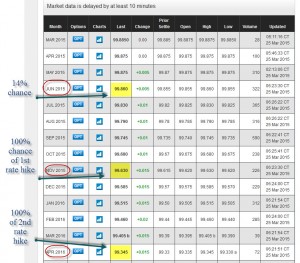

While many still believe a June rate hike is imminent, the futures market is saying, “Whoa, hold on just a minute!” The implied future for June is only 3.5 base points lower than the current state, hence there’s a 14%  chance of an implied 25 base point rate hike, a perfectly normal size and one mentioned frequently by Fed officials. (I got the probability by dividing 3.5 by 25.)

chance of an implied 25 base point rate hike, a perfectly normal size and one mentioned frequently by Fed officials. (I got the probability by dividing 3.5 by 25.)

If we take a look a the Fed Futures Fund, we see a 100% implied probability of a hike around November, and a second rate hike all the way out in April 2016. While this is a dynamic bond and can move with news (after the Fed meeting last week, the bond moved sharply higher to decrease the implied odds of a near term rate hike), this is still a great predictor. Any data that implies hotter inflation expectations will drop this quickly, but as of right now, any rate move before September is highly unlikely (the September implied is only a 58% probability).

So, as the Fed tells us, pay attention to the data, as they will be paying attention to it, too – and they will move accordingly.