After finishing the first full week of trading in 2016, there was nothing to be happy about. This was the worst start ever in the history of the stock market, and it all points to some more bad activity on the horizon. With earnings season around the corner, there is nary a stock that is in position to make a move to higher ground. Hence, it’s time to do a little stock market analysis to understand how unhealthy 2016 really is.

So, to answer question on everyone’s mind – Why is the stock market down so much? – let’s dive in.

Black Swan events are hitting the markets

Unfortunately, the answer is not one we want to hear. 2016 is turning into the year of the black swans. Four black swan events hit this week: North Korea tested a nuclear bomb, China’s stock market plummeted and then they devalued the yuan, and the conflict between Saudi Arabia and Iran heated up. These events sent a sobering message to the markets: “Be very aware.”

The Fed’s policy is unnerving traders

The Fed is far more hawkish now than they have been since 2006, which was the last time they raised interest rates. What’s interesting, though, is that not many traders are aware of the implications of a shift in policy. Remember what Marty Zweig said so many years ago? “Don’t fight the Fed!” I don’t care if rates are near zero – a policy of rate hikes is NOT accommodating. They will spin this in the other direction, but that is not the truth.

Institutions are selling

The Dow Industrials plunged 1,000 points (or 5.7%) last week on very heavy turnover. This is a sign of institutional selling (or distribution), which occurs when the “big boys” sell stocks at a rapid rate. There is no discussion of what to do; when big funds are selling, you get out of the way. You might believe that there’s an opportunity here to buy at lower prices, but I would suggest caution and patience at this point.

Many stocks are in a bear market

Over half of all stocks are in a bear market after falling 20% or more. These stocks are in their own personal purgatory, and some sectors like energy and services have been bludgeoned. As traders, we don’t catch falling knives. There is no reason to buy now in an attempt to be a hero. How many bottoms were called back in 2008 until we actually hit the final bottom? (More than I can count!) How much emotional, mental and real capital would have been saved by just being patient back then? Exercise that restraint now.

The indicators are not looking good

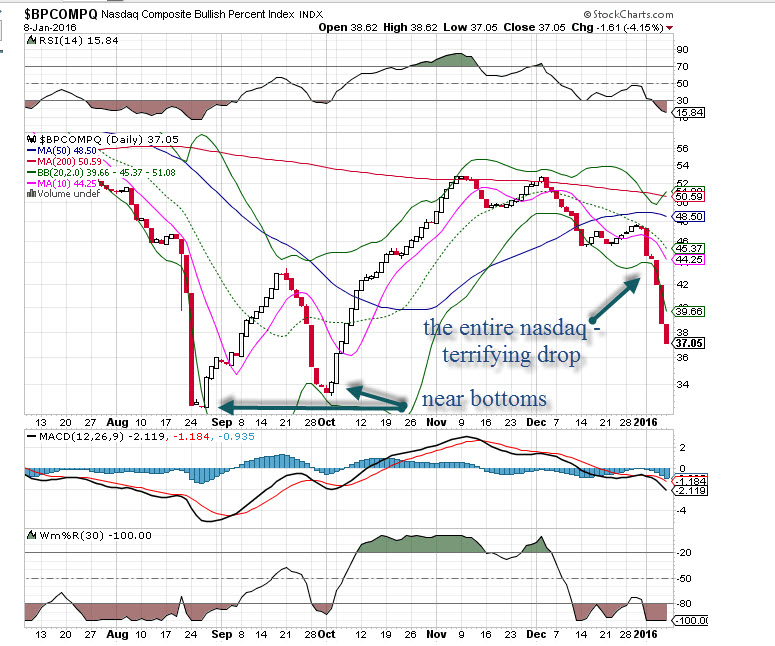

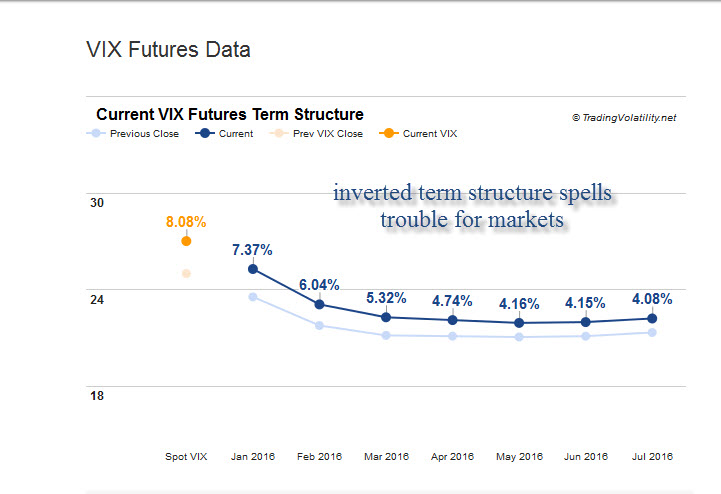

Volatility is spiking, much as it did in August. Option premium is swelling, as the market is expecting big swings in both directions. Put/call ratios are elevated, and that is normally a sign of real fear. But what is truly concerning are the breadth statistics. These have been weak since peaking in June 2014, which means there have been eighteen months of heavy distribution – sometimes interrupted.

Currently the McClellan Oscillator is at extreme oversold levels, indicating a powerful snapback rally is due. We’ve been used to a stretched rubber band that snaps far enough to have a slingshot effect on the market, but those days are over. I’m not sure there is enough interest this time around to buy a major dip, but that remains to be seen.

Plus, with earnings season ahead, it’s not smart to be short in front of it or during it, but we’ll have to see how the pace goes. An oversold market doesn’t automatically mean it’s time to buy.

Remember: Trying to pick a bottom is a loser’s game.

Copyright: luislouro / 123RF Stock Photo