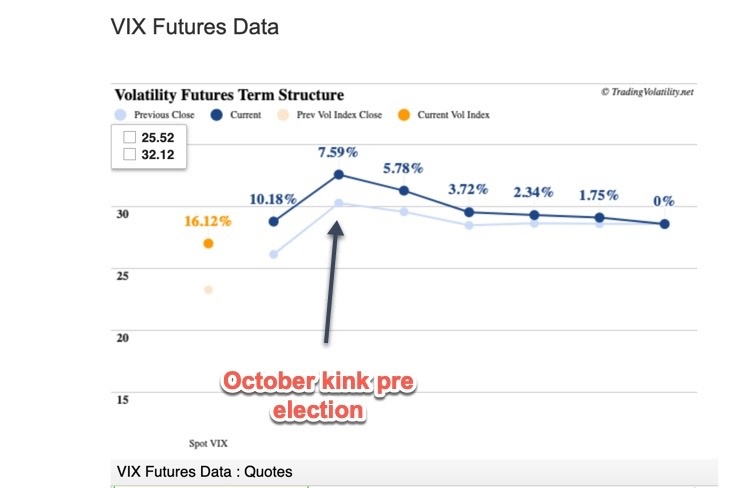

Traders always need to watch volatility (via the VIX indicator), especially the term structure, which looks several months into the future. VIX futures give us a good idea of where the big money is going at certain points in time.

In the short term, we learn if protection will pay off (it will when the VIX cash indicator aligns with futures). Over the long-term, the VIX gives us an idea of where the market will be most volatile. It’s often benign, but it’s not right now. There is something peculiar about the VIX futures, indicating big movements are coming.

What VIX futures are telling us

As you can see from the above chart, there is a kink in the curve. That represents the October future, which expires on October 21. The October future projects 30 days of volatility until November 20 or so. In between, there is a little thing called a presidential election.

In 2016, most of the action occurred the evening of the election. Are traders preparing for a big night of volatility? That makes some sense, until you realize that October futures were bought months ago, before we even knew who the Democratic nominee would be.

Does it really make sense to buy large quantities of protection for long portfolio positions that far out in time? The premiums these traders paid months ago were enormous, and most of the contracts remain open.

If there is little volatility leading up to the election, a very big seller could hit the October future. When volatility futures drop with the VIX, we often see markets screaming higher.

We don’t know how things will shake out. We only know that some money is being wagered on increased volatility and wider ranges. Once the news is out, there may not be any reason to hold that protection.