One of the best ways to measure market volatility is the VIX index, which basically is an expression of the demand for puts and calls on the SPX 500 index. Some will define it other ways, but simply put, that is the most raw definition – and really suits our purposes here.

When the VIX is on the rise, so is fear. Put buying becomes rampant as traders move to protect portfolios in the event of individual selling, institutional distribution, or another negative event.

A rising VIX implies elevated option values, and that protection becomes expensive to purchase. Likewise, a falling, or low, VIX implies cheaper option premium and a willingness to hold positions – it displays confidence in taking on risk.

What we describe above is the VIX cash, which represents a 30 day future value (or expectation) of market volatility (traders also have the liberty of using the VIX futures to trade or hedge positions).

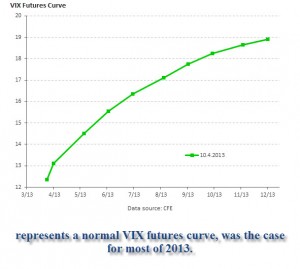

Now, the VIX futures curve, or term structure, is shaped like any commodity or future. Conditions are defined as contango or backwardation (more on those in another blog post). An upward sloping curve (in contango) means a healthy volatility curve, and when there is excess premium at each time period, it’s even better (see picture). Traders are willing to pay more for volatility further out in time, which is normal. When the VIX curve is in backwardation, the opposite is true, and we often see a bear market condition.

Last week, we saw the VIX cash jump over six future strikes (see picture below). Monday it corrected some but not enough, and I suspect unless something really changes, we’ll see this curve back into contango within a couple of days.

In the current situation, nothing much has changed other than a market undergoing a modest correction. Even during a correction, we see players reaching (over-reaching?) for protection, especially coming off a year like 2013. It makes sense, doesn’t it? So, if the market can swing higher on Tuesday we’ll see the curve go back to normal, and just in time as big news hits the Street (Fed, earnings, GDP, other big economic data, end of January).

As I mentioned in this article about premium selling, we can all take advantage of these high volatility spikes. Understanding the conditions and the situation, learning the movements and rhythm of markets, and tactically placing our bets give us the best odds of success.