Bulls have held the advantage lately; any spike in volatility has been quickly sold down. But things changed on Friday. Volatility is spiking, and traders went into risk-off mode.

Take a look at the VIX chart below and you’ll see that the last two spikes prior to Friday ( up to 16 and then 17) were pulled down sharply by the end of the day. Yet, some fear seemed to seep in as we headed toward the weekend. Was it warranted? I’m not so sure. With that said, I know from past experience that when volatility spikes, it may be time to take a contrarian trading stance and look for the markets to reverse higher.

Friday was a risk-off day

We woke up to find to European markets down sharply – Germany’s DAX index was down 2% – and I immediately though that the bulls were in for a challenging day, a no-bid market with little to do but sell holdings and/or buy protection. On a risk off days, not only does volatility get bought, but we see a rise in the dollar, bonds and maybe gold as equities are shed. That was the case last Friday.

Volatility is spiking – why?

Why does the VIX run higher? Many call it the fear gauge, but I prefer to call it the uncertainty index. Volatility rises not because of a fearful outcome; it rises when there is uncertainty about an outcome on the horizon. Currently, we have two uncertain outcomes that the market is wrangling with: Fed policy and a “Brexit,” a British exit from the EU. Let’s look at both.

Uncertain Fed policy

The odds in favor of a rate hike were raised sharply after some Fed Governors made hawkish statements this spring. Their chief complaint was that the market was not pricing in a potential rate hike at the June meeting, which in their view continued to be possibility.

As a result, expectations for a rate hike quickly surged from single digit probability to over 40%. But then the ugly jobs report on June 3 brought those expectations down to almost nil.

The next Fed meeting is in July, and the probability of a rate hike is now hovering around 20%. So, clearly the market is not worried about whether or not there will be a rate hike. The confusion that persists around the event is causing fear. Once the meeting is over, I suspect the fear will be removed. We have seen this happen at just about every meeting when there is confusion that ultimately gets settled. Markets move along on their merry way.

No precedent for a Brexit

The Brexit is a completely different issue, as there is no precedent for the outcome. On top of that, polls have shown that the outcome is a toss up, and the media has hyped this as an extreme event. In all likelihood, only currencies will be affected, and they may move wildly up and down – but that’s not a guarantee. Last summer, Greece was nearly kicked out of the EU. Fear rose sharply and then declined once the issue was settled.

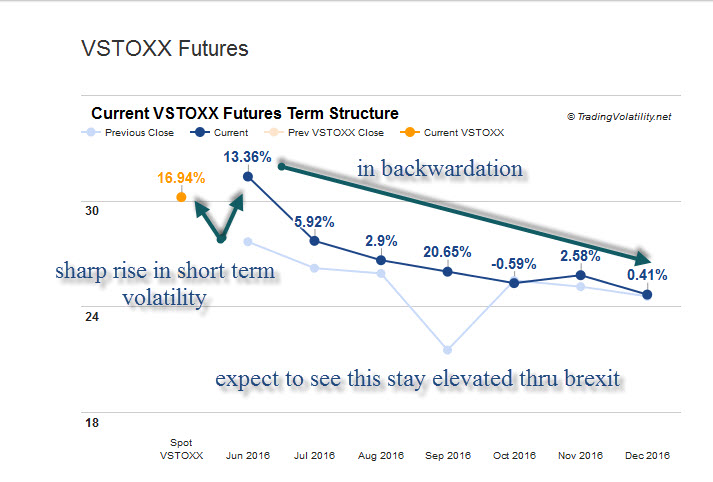

As we can see from the from the VSTOXX Futures chart (volatility from the euro stox 50 index), the curve is in “backwardation.” Simply put, market players are fearful of the unknown and buying short term protection via market puts, just in case something really bad occurs after the Brexit vote.

The bottom line

When volatility is spiking and investors are unsure about an outcome, they look for the exit door. Some of them run through it. Volatility then spikes, but as history has shown, this is a temporary moment of insanity. When the smoke clears, markets often resume their previous path.

Copyright: sifotography / 123RF Stock Photo