The Fed will hold a two-day meeting this week, the first scheduled one chaired by Janet Yellen. The meeting will include a lot of new information, an update to the economic forecast and inflation expectations, the rate decision, and a press conference hosted by Ms. Yellen.

I do not expect any change in the rate or the taper (the current strategy is focused on bringing the monthly purchases down another $10 billion to $55 billion), but I do expect a slight tweak in the economic forecast. There continues to be persistent deflationary fans blowing throughout the economy, this will likely keep inflation expectations below the desired trend. We did see a small price pressure in the last GDP report, but one number does not make a trend. However, it was notable.

In her few public appearances this year, Ms. Yellen has not deviated from Ben Bernanke’s approach, which involves instilling confidence about the Committee’s commitment to Fed Policy. That said, they have continued to talk about watching the data for clues that may shift policy. Reducing bond purchases should continue until it winds down through fall of this year (six more meetings or less). The extra stimulus is not needed to get the economy moving, but the Fed will be vigilant and watch for any potential deflation that causes prices to erode (and thus requires a re-ignition of the stimulus).

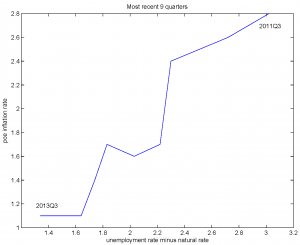

For the past few years, the Fed has stated that they believe the economy is not growing at full potential and is not at full employment, which supports the policy of increased accommodation. The unemployment rate, which has been the target of some discussion lately, is NOT directly related to removing stimulus – unless the slack in the job market is removed and there is wage inflation. So far, that has not been the case. If you may recall from your economics class, the Phillips Curve is an inverse relationship between inflation and unemployment. Again, this is not the case today. However, with so much slack in unemployment, it could take years before this relationship again takes hold and companies have to start paying their employees higher wages.

The charts below show a normal Phillips Curve and the current one, which is inverted. (If you need an explanation, email me at bob@explosiveoptions.net).

The bottom line is this: With so much fear being seen around the world, the transparent Fed is likely to put any uncertainty to bed with this week’s meeting. Not many are expecting any bold action, and as the Fed are gradualists, I agree that this will be a pretty mellow meeting.