Today we are going to talk about option order flow, a technical resource that every successful options trader must understand and use – and not just because it can help you bank HUGE profits (more on that below!).

Before we dive into order flow, lets talk about technical basics. When it comes to technical analysis, there are two primary things to keep your eye on: price and volume. Price is king, of course, and must always be respected.

Volume, as you might guess, is queen. It can provide us with clues as to future price direction, but it can also throw us for a loop. I tend to look at where the big money is flowing, but unfortunately, the information we get from stock volume can be noisy, deceptive, late, or even absent. Ever hear of “dark pools?” This occurs when a stock is traded at high volume and in semi-secrecy by institutions. The public may not know about these transactions for days or weeks, and that time lag could make the difference between winning or losing a trade.

Luckily for us, options trading is different from stock trading, because there is no such thing as a “secret” trading room. Dark pools do not exist in the options trading world. However, there is a way to track high volume options trades, and that is called option order flow.

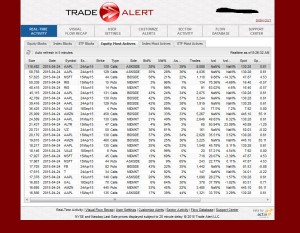

For me, option order flow, or the flow, is one of the best options trading resources out there. You can use many different platforms, but my preferred is the Trade Alert system/scanner that my good friend Henry Schwartz publishes (see image below).

Trade Alert tells us where big option trades are being made. Analysis includes the size of the trade, the type of the trade (buy or sell), and the name that is being traded. It includes the same information distributed by other services, but I like this one for the interpretation of the data, which allows me to quickly jump on the trade that is most valuable.

In short, Henry’s Trade Alert puts me at the starting line alongside the big money players. I can determine if the flow is good or not and capitalize on it, automatically giving me an edge.

Option flow is pretty easy to understand, but it requires a belief that high volume leads to higher prices. Without this notion in mind, you will never be able to use it for a trade setup.

Now, I know I talk a lot about how important the chart/technicals are to determining trades, but sometimes the flow trumps the chart. In other words, a big money flow indicates something big is coming down the pike but that big “thing” does not want to be seen – at least, not right away. Of course, we have to interpret the flow CAREFULLY to make sure we’re not chasing something that is not there.

Here’s just one perfect example to illustrate my point. In February and March, there was some major flow in Kraft (KRFT), a stodgy old company with slow growth. Meanwhile, the chart was not flashing a buy or sell signal; it simply said, “avoid.” Very contradictory!

The flow was focused on the June $67.5 call contract; 20,000 of these were purchased for about 70 cents in one day. Other days saw some good flow as well (but not as much). The premium paid here was $1.4 million (20,000 x 100 x .70).

At the time the stock was trading in the low $60’s, so why would someone be inclined to buy this many calls at a strike far out of the money (more than 10% away from break even on these calls)?

Well, if you followed this flow and rode along with this big elephant, it paid off big time. Kraft had struck a deal with Warren Buffet and Heinz. The stock soaring past $86 the day this announcement was made public. Those $67.5 calls? The day before the news broke, they were at 40 cents. In 24 hours, they were at nearly $20. Yup, that 20,000 buyer banked a cool $37 million in profits! And the options are still good for another couple of months.

Now, this may seem the outlier, it’s just one example of many. Want to learn more? It is the focus of this week’s April 30 webinar, when I’ll be talking more about flow, discussing additional examples, and sharing real-time ideas that have the potential for a big-time pay day.

Sign up for it today, as I am expecting that the webinar will fill up quickly.